Seeking a home Equity Loan first off a corporate?

If you individual your home, you should use property guarantee financing or home guarantee line from credit to fund your business, however need place your family at risk.

Of numerous or all of the companies looked offer compensation so you can LendEDU. These types of profits try exactly how we take care of our very own 100 % free service getting consumerspensation, as well as days regarding when you look at the-breadth article look, decides where exactly how organizations show up on the website.

Home equity financing and domestic guarantee personal lines of credit (HELOCs) let you turn the newest equity you have manufactured in your home to your cash. Loan providers generally speaking cannot restrict the method that you use the money from this type of fund, very using a property equity mortgage to start a corporate is actually something that you will do.

But not, even though domestic collateral money is a selection for financial support the company doesn’t mean they’ve been the best choice. Home security fund are going to be high-risk while they place your family up because guarantee. There are many resource options for carrying out a business which could getting a much better options.

1) See if youre qualified to receive a property equity loan or HELOC

The initial thing you have to do was guarantee that you will be eligible to rating an internet credit fund to possess bad credit home security financing otherwise HELOC.

One of the many items that loan providers evaluate having home collateral fund and you may HELOCs, besides your credit history, is the loan-to-really Riverside bad credit personal loans worth (LTV) ratio. Which proportion compares how big your home loan into worthy of of your home. Really lenders reduce matter might give to you personally in order to 90% 95% LTV.

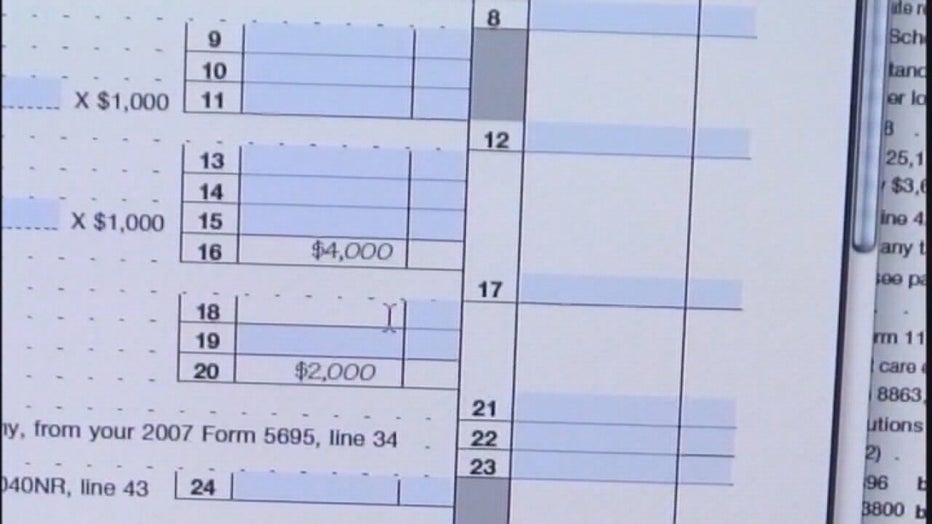

Like, for individuals who own property really worth $five-hundred,000 and you can work at a loan provider that have a max LTV out-of 90%, you can’t get a loan that would push your house-related debt past $450,000 (90% of one’s residence’s value). If for example the home loan balance try $350,000, which means your own limit mortgage are $100,000.

You can make use of the house collateral online calculator to acquire your own newest LTV and how much you happen to be entitled to acquire.

2) Decide if playing with household equity to start a corporate ‘s the correct move

Its also wise to feel free to look at whether or not using your house collateral is the better answer to financing your business. Domestic collateral fund and you will HELOCs make use of house because the collateral, placing it at risk. If you fail to spend the money for mortgage, the bank you are going to foreclose on your own home.

If you utilize unsecured loans, you’re not putting your home in the lead chance. You need to be positive about your online business and take good significant risk of using your family guarantee to invest in your organization.

3) Go after property collateral financing against. an effective HELOC

Home collateral fund leave you a lump sum of cash you to you can utilize as you need. The rate for a home guarantee loan might be fixed, which means you normally predict the monthly payment across the existence of the financing. They are ideal for highest, one-time expenses.

HELOCs change your home for the something similar to a charge card, providing the option to attract regarding the equity in your household as much since you need so you’re able to inside the HELOC’s mark period. HELOC pricing always start lower than family collateral financing prices, however, they might be variable, so that the price you are going to increase through the years.

HELOCs are right for businesses that can get brief, constant expenditures that you should defense. A family you to definitely daily needs to get the latest index can benefit from using a beneficial HELOC more than a home security financing.

4) Select a loan provider to partner with

Having almost any loan, choosing the right bank is very important. That is the same if you are finding a house equity mortgage or HELOC. Finding the time to help you comparison shop could save you a great deal of money.

Perhaps one of the most issues to compare between lenders are the speed that every lender also provides. The lower the interest rate, the greater as all the way down rates reduce your monthly payments and you will suggest you’ll be able to pay reduced with the mortgage overall.

One more thing to examine is the closing price of the borrowed funds. Most house equity loans and you can HELOCs possess initial charges. Handling a lender with all the way down or no costs can save you plenty of cash.

Don’t forget to seek advice from the lending company that you use to own your own financial or bank account. Of many promote loyalty incentives which can make even offers a great deal more aggressive. Our very own courses to the ideal family security funds and greatest HELOCs helps you start seeking just the right bank.

5) Use your funds and begin installment

Once you have obtained your loan or HELOC, you’re happy to make use of the financing and begin paying your debt. Just remember that , home guarantee finance have a lump sum, while you are HELOCs enable you to create several pulls in your home’s guarantee when you need to do thus.

The brand new payment out-of family collateral fund and you may HELOCs are a bit various other. With household guarantee finance, repayment usually starts straight away. Possible begin getting monthly bills and now have to deliver a fees every month.

Which have a beneficial HELOC, you just need to make money by using the new HELOC in order to borrow money, much like credit cards. When you look at the mark period, you could obtain regarding the HELOC, pay back the balance, and obtain once again as much as you need so you’re able to, doing your own credit limit.

After the draw period finishes, always from the 10 years, you’ll be able to begin getting an invoice toward HELOC equilibrium. It is possible to routinely have to invest the balance off across the next ten to fifteen ages.

Domestic equity funds against. home business finance

If you’re not certain that utilizing your domestic security is the most practical method to pay for your organization, you will want to take care to envision other options. Of many loan providers render specifically made small company fund to help people rating the newest enterprises off the ground.