At the most basic level, when a company draws up a budget, it is a way to plan for the future, avoid overspending, and measure its strategies. Whether your clients are creating a budget or trying to identify the most effective production methods, standard costs provide a useful data point. For example, if a client is trying to create a budget and knows prices are going up, it can add the projected increase in materials to the standard price to create the budgeted amount.

What is a flexible budget in standard costing?

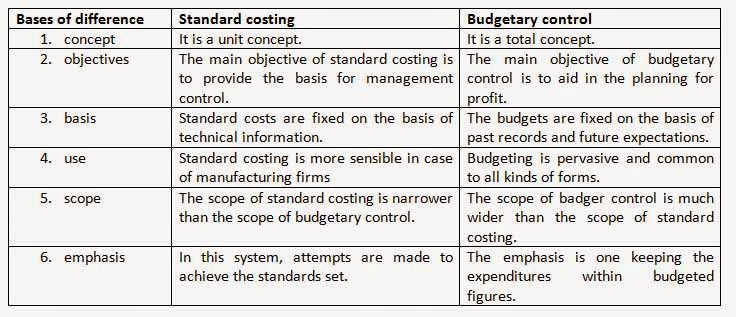

Budgeting and forecasting help business firms to fix a target of finance, control and monitor the resources as well as for decision-making. Budgeting is like a road map that tells you where and how much you are going to spend and how much you will receive. Meanwhile, forecasting is like a crystal ball that tells you how much you will receive in the future and how much you will spend in the future. Although they are used primarily for decision-making, they have different structures, approaches, and periods. Standard costing focuses on cost variances, whereas budgetary control examines variances in budgeted vs. actual financial performance across all areas. Standard costing is used to set cost benchmarks for production elements like materials, labor, and overhead, facilitating cost control and efficiency.

Is there any other context you can provide?

Quantity variances occur when the cost is a function of the number of units used during production, and therefore apply only to variable costs. Fixed costs by their nature are fixed do not vary with the quantity of units used in manufacture and therefore do not have a quantity variance. Qualitative forecasting mainly differs from quantitative forecasting in the type of data it uses. Qualitative forecasting relies on expert opinions, insights, and subjective interpretations, often gathered through methods like focus groups or surveys. It is useful when there is little to no historical data available, such as for new products or markets. In contrast, quantitative forecasting uses numbers and statistical models to make predictions about future trends and is therefore objective and data-driven.

What is your current financial priority?

He has worked as an accountant and consultant for more than 25 years and has built financial models for all types of industries. He has been the CFO or controller of both small and medium sized companies and has run small businesses of his own. He has been a manager and an auditor with Deloitte, a big 4 accountancy firm, and holds a degree from Loughborough University. Allowing for normal inefficiencies, the product is expected to require 0.50 hours of labor at a cost of 15.00 per labor hour.

What is Budgetary Control?

This approach is data-driven and often more accurate than qualitative forecasting as it helps businesses identify patterns and make data-backed decisions. Budgeting provides a long-term financial roadmap, while forecasting is real-time and updates according to current trends. With budgeting and forecasting combined, companies can achieve financial stability through efficiently using resources. Budgeting gives a framework for budgeting resources; forecasting makes it a bit more adaptive by generating continuous projections to support in-between-year decisions. Both of these operations are crucial for financial discipline and responding to market shifts.

And Then…Budgeted Costs?

Direct costs such as materials are directly related to production, while indirect costs refer to expenses such as labour and overhead. Standard costing and variance analysis is usually found in manufacturing businesses which tend to have repetitive production processes. It is the repetitive nature of the production process which allows reliable and accurate standards to be established.

Budgeting establishes the framework for budgeting resources; and forecasting makes it a little more flexible because it generates continuous projections that make it easier to support decisions made between years. Both of these operations are necessary to exercise financial discipline and respond to market changes. Accurate demand forecasting helps businesses optimize inventory levels, manage production, and avoid overstocking or understocking. Forecasting involves predicting future business outcomes by analyzing past financial data, current financial status, and anticipated achievements.

- Standard costing is a method of cost accounting in which a company assigns a predetermined cost to each unit of production or service.

- Rolling budgeting is a continuous process where budgets are updated regularly, mostly every quarter.

- In short, standard costing sets costs that should be incurred while budgetary control compares actual performance to the budgeted performance.

- This keeps organizations nimble and ready to deal with whatever makes its way into their path.

- The standard costing price variance is the difference between the standard price and the actual price of a unit, multiplied by the quantity of units used.

- For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online.

Budgeting and forecasting are highly effective financial management tools used by all organizations to provide the framework for financial planning, decision-making, and resource management processes. Budgeting is defined as a structured financial plan showing expected income and expenses. On the other hand, forecasting can be a flexible assessment of an organization’s current financial position based on developments in the market. The distinction between budgeting and forecasting helps organizations make better decisions, ensure efficient management of cash flows, and align operational goals with financial realities. Budgetary control is an all-rounded financial management technique where budgets are prepared for the different departments or projects, actual results monitored, and then compared with budgeted targets.

Standard Costing imposes cost standards primarily against production efficiency for controlling expenses. Budgetary control, on the other hand, is all about planning, controlling, and adjusting financial targets of the whole organization. Using both methods together helps businesses attain operational efficiency and align financial performance with strategic objectives.

With easier processes of advance disbursement and integration of different categories, EnKash streamlines financial management, providing insights, and offers control for better forecasting. This comprehensive solution enhances better opportunities for financial planning and makes the decision-making process more accurate. Budgeting and forecasting is a lengthy and resource-intensive process, particularly for large, complex organizations or business units with many different activities and financial transactions. Many small or under-resourced businesses or organizations will not have the time or manpower to develop detailed budgets or to update those forecasts on a regular basis. Zero-based budgeting requires justifying each and every line item, which is a time-consuming and resource-intensive process.

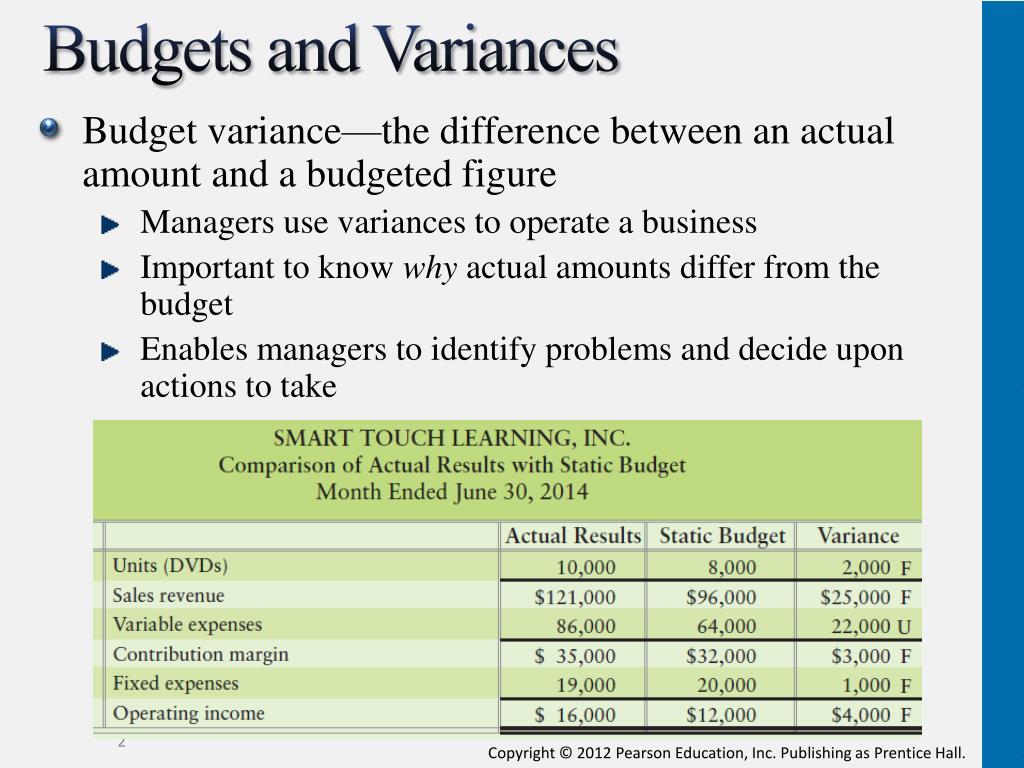

Standards focus on operations aspect of the business whereas budgets mainly focus on the financial aspect of the business. In a standard costing system, the standard costs of the manufacturing activities will be recorded in the inventories and the cost of goods sold accounts. Since the company must pay its vendors and production workers the volunteering actual costs incurred, there are likely to be some differences. The differences between the standard costs and the actual manufacturing costs are referred to as cost variances and will be recorded in separate variance accounts. Any balance in a variance account indicates that the company is deviating from the amounts in its profit plan.