Your imagine your college flat are smaller — that is, until you started viewing smaller residential property pop up everywhere. They make one to flat look like a residence in contrast. Even so, since the popular HGTV servers has been doing an element toward this type of tiny, efficient palaces, it may seem you to definitely smaller lifestyle isn’t including a detrimental suggestion. Whatsoever, this type of properties dont pricing far, getting little more than very appreciate sheds, and with what you’re using on your own figuratively speaking, a smaller houses commission appears pretty good right now.

Smaller Land: Several Very first Significance

Smaller house straddle brand new line anywhere between individual assets and you may a residential property, according to the variety of framework and connection. Such distinctions are very important as they affect just how financial institutions have a tendency to approach a buy.

Individual house is anything that you possess and will move about. This consists of your own lamp, the chair, the car and you may, possibly, the smaller domestic. When a small residence is centered close to the floor, to the concrete prevents or into a truck, you might essentially assume that it is legitimately sensed private assets.

Concurrently, a tiny house attached to a little foundation, end up being one a good slab, an excellent crawlspace or a little cellar, try real estate. One home is permanently affixed to this piece of land, literally. This gives it besides the chance to see an upgraded judge condition, they will will get a block of land amount, an appropriate breakdown, identity and an income tax review.

Because a tiny domestic can go in either case, it is possible to strike a number of hurdles trying to finance one. You may want to believe that your house is safely attached to the house, however your appraiser and you may bank can get differ. Or you will discover one to zero loan providers close by usually mortgage toward a residential property valued below a specific tolerance. Its a pickle, to make sure.

Small A mortgage Options

Based in the event the small home is noticed a house otherwise private assets, you have certain various other financial loans. A little family which is real estate possesses satisfied local building codes naturally (in lieu of being made in the best buddy’s yard as the an accessories strengthening, including), may be able to be eligible for a traditional mortgage using FHA, Virtual assistant or even Fannie mae if it’s not super quick. This type of applications have minimum meanings for what property try that’s not.

Lightweight residential property which might be experienced personal possessions, additionally, should be financed several different methods. Understand that these fund get hold greater interest cost and you can faster conditions, therefore, the percentage you will be expensive, regardless of the tininess of your own whole state. Look into this type of persnal signature loans choices first:

FHA Cellular Financial

The theory is that, you can use to order a tiny family if it is handled such a mobile family to own financing objectives. FHA provides fund to possess family and you will property integration sales, home-only sales and you will belongings-just instructions (and if this new intent is to try to plunk their smaller house on it). In practice, it may be very hard to even get a hold of a person who will make such loans, let alone qualify for one.

Camper Financing

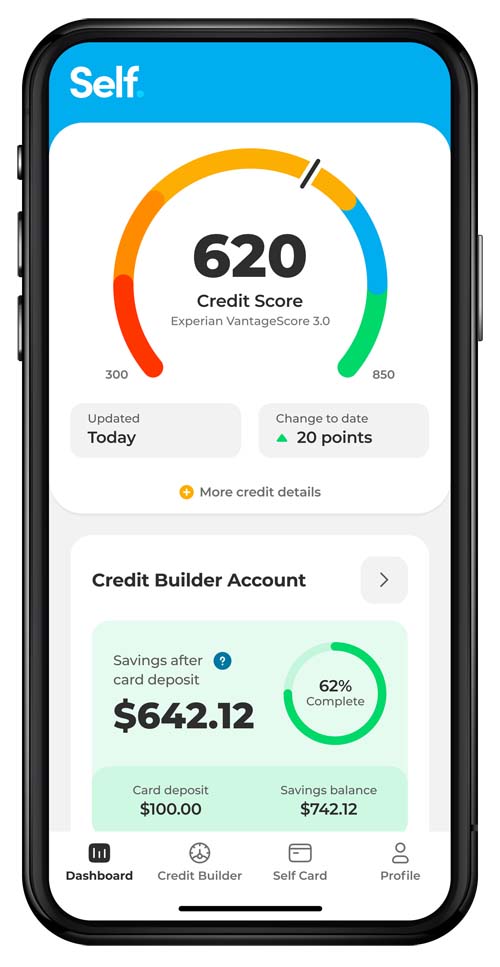

Now our company is talking. If your smaller absolutely nothing household features wheels that is authoritative from the the latest Sport Auto Community Relationship, you may be able to find a keen Rv financing to pay for the expense. These financing keeps high-than-home loan prices, but they’re not dreadful, often capping away up to 8% which have terminology for as long as 84 months, depending on how well you might be starting from the borrowing from the bank service.

Signature loans

Having good borrowing, it is possible to take-out an unsecured loan out of your bank otherwise borrowing union. It cash is entirely untethered from your own lightweight home, so that the rates might possibly be high, but you and usually do not place your family at stake if some thing was to wade poorly completely wrong on the financial life. Just remember that , it mortgage would be pricey versus anybody else and you can perhaps possess a smaller title since the simply make certain your lender has which you yourself can pay it back is your keyword.

Builder money

Alot more lightweight domestic structure artists is investment their work thus some one as you is also increase into the smaller family market. Ask your dealer from the investment that may be available as well as how much you’ll need to set out so you’re able to safe it. This might be a good solution, since you score all you need in one single spot, saving some time a possibly immense horror off having economic doors criticized in your face for hours on end.