- 31 year Repaired 30yr Repaired

- 15 year Fixed 15yr Fixed

- 5/1 Sleeve 5/1ARM

You are able to do everything on the web that have Rocket Home loan – that’s the basis about their creation. Back to 2015 during their launch, Quicken explained, we have been obsessed with looking for an easier way to simply help our subscribers score a mortgage. That is why i create Skyrocket Home loan, an entirely on the web, self-solution home loan experience. However, you could nevertheless correspond with a mortgage specialist from the cellular telephone or via on the web cam any moment along the way.

The net procedure starts with the program for very first home loan recognition, hence just like the claimed, requires times. Then, you can begin an entire application procedure and you will family-to shop for procedure which takes stretched. How much time regarding acceptance so you’re able to mortgage intimate hinges on debt problem together with household-related items including the assessment.

You could bring every required financial files from the on the web interface named Rocket Home loan (formerly known as MyQL). From this portal, you can access new reputation of mortgage 24/7. Having reputation while on the move, you might down load the newest software for Android otherwise Apple users.

Can you Qualify for a home loan Away from Rocket Mortgage?

Skyrocket Mortgage discusses plenty of factors to know very well what loan issues you qualify for. FHA loans have the reduced lowest credit history, at 580. Very antique fund will require a score throughout the a good credit score assortment, otherwise finest. You can find a minimal prices and more than sensible terms and conditions was open to individuals with high credit scores. This is exactly a primary reason very loan providers craving homebuyers in order to increase credit ratings prior to trying to get a loan. They saves you excessively currency along the direction out-of home financing.

A different sort of foundation that is felt will be your obligations-to-income ratio. It’s your total monthly loans compared to the overall month-to-month income. It is looked at to choose if or not you can afford a monthly mortgage payment. Car costs, student education loans, personal credit card debt and child support all of the fall into personal debt that can come under thought. There are your fee by the figuring your own monthly obligations and you may separating by your gross (pre-tax) monthly income.

Down-payment discounts is another factor to have loan qualification the sites. The norm was 20% of the house purchase price, however, specific apps, such as Va loans and FHA finance feature reasonable or no advance payment criteria. Just in case you you should never be eligible for an authorities-recognized real estate loan, needed individual financial insurance coverage for folks who place less than 20% down.

What is the Processes for getting a mortgage Having Skyrocket Financial?

The first step try creating an account on the Rocket Mortgage’s webpages. Upcoming, you are able to respond to a great amount of questions relating to your geographical area, for which you want to buy, who will be toward financing with you as well as your monetary suggestions. This can include a job records and you will paycheck. Their possessions and income are required along with your Public Safeguards number having a credit check. Skyrocket Financial combines with a lot of banking companies very you can log in to your bank account really from system in the event the you want to be certain that the assets utilising the quickest strategy available.

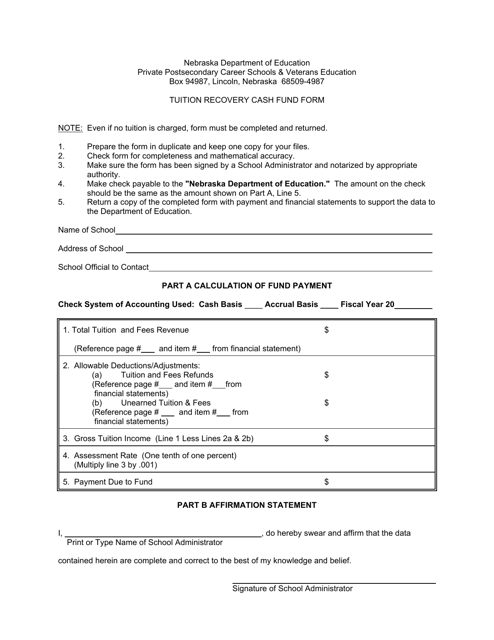

When you have done entering the requisite suggestions, you will observe an excellent countdown. After a few times approximately, Rocket Financial usually display screen which fund your be eligible for. This might include fixed-rate otherwise adjustable-price mortgages, otherwise specialized finance including Va otherwise FHA. There is a good slider pub which can help you see just what happens for those who change the financing name, interest or settlement costs.

If you find an alternative that suits your circumstances, you can lock their price into the and you will upload the application to have acceptance. Skyrocket promotes that you’ll find out if you’re recognized within minutes. Whenever you are, you can print an acceptance letter to simply help confirm their intent purchasing to an agent. If you have a buy package buying a property, you can easily run Skyrocket Mortgage to undertake the mortgage. Filled with creating a closing date and you will progressing that have our home-centric portion of the family-to find procedure, like the assessment and house check.