Facts loan pre-recognition

Loan pre-approval-also referred to as approval the theory is that or conditional recognition-is when loan providers agree to financing your a portion of the loans that go to your buying your domestic, but i have perhaps not OK’d a complete amount otherwise given final recognition. Generally, its verified written down ahead of time and also the conditions are unmistakeable. Constantly getting loan pre-recognition, a loan provider can look at your credit score, your revenue, as well as your assets to determine what finance you happen to be acknowledged to have, exactly what your rate of interest could well be, and just how much you need use.

To help you express your search, discuss with depend on, and you can bid with high certainty if you wade to market, loan pre-acceptance will give you a far greater feeling of your own limit readily available capital. While pre-approval isnt necessarily required in the entire procedure for buying property, its a very important step in gaining your dreams of having an alternate family home or investment property. In short-it will potentially help make your lifetime a beneficial heck of numerous simpler.

The great benefits of getting your mortgage pre-accepted

One benefit of getting your loan pre-recognized would be the fact it is to possess a specified count, meaning you get to go shopping for house otherwise features your understand it is possible to afford. That make the entire process this much easier and this, for folks who bid on an activity, state, there will be the newest max quote available. Such as, if you are considering a property cherished from the $five-hundred,000 plus one cherished in the $700,000, when you’re pre-accepted having a mortgage away from $five-hundred,000, you will know this new costlier household could be beyond your budget, unless you envision paying more of their currency.

To help you a prospective supplier, being pre-approved might make you a very attractive consumer, because shows that you are much more serious from the purchasing the house and therefore your own render is not as probably be withdrawn due to deficiencies in finance.

The latest drawbacks of going the loan pre-approved

This loans in Ignacio new cons of going the loan pre-accepted is limited, if you do not have multiple pre-approvals inside the a brief period of time, that could possibly ruin your capability in order to borrow. Having numerous pre-approvals, one after the other-along with one or more financial-you can expect to give the impact that you’re financially erratic. Plus: people pre-approvals is apparent on the credit reports as a loan enquiry, so that they can be detectable. Past you to analogy, you should find pre-acceptance specially when you are positively given buying a property as an alternative out-of trying to get pre-acceptance once you could possibly get only be amusing the idea.

Pre-acceptance compared to. pre-qualified: what’s the differences?

First, pre-approval and you will pre-degree one another offer an insight into how much cash it’s possible locate approval getting. If you find yourself you can find loan providers which use pre-recognition and you will pre-degree interchangeably, both techniques do contain some variations.

Pre-certification setting you aren’t required to give the exact same top of monetary information just as in pre-approval, which means your lender doesn’t eliminate your credit history. Meaning you will only located quotes, which also means the amount you are accepted getting, the pace, additionally the financing system you are going to transform depending on the info given on bank. Typically, you don’t need available data such as shell out stubs or bank comments contained in this phase, while the pre-qualification is just a primary summary of your financial information.

Versus pre-certification, pre-approvals are much so much more thorough. In the pre-recognition processes, you’ll likely be asked supply information and you will papers getting spend stubs and you can bank comments, eg. In other words: a beneficial pre-approval needs a painful credit assessment.

Factors to consider when trying for the home loan pre-acknowledged

Points one to lenders think for the home loan pre-recognition techniques tend to be your credit score and verification of your earnings and work. Lenders also consider your debt-to-money, otherwise DTI, proportion. The latest DTI proportion, a portion, computes your financial situation each month with your earnings monthly. New DTI fundamentally suggests lenders that you earn sufficient currency in order to relatively shelter your financial situation. This new DTI required to become accepted to own a home loan differs depending on the financing method of. Essentially, you’d require their DTI is fifty% otherwise quicker.

How to make an application for an effective pre-accepted mortgage

Review your existing cash. Whenever you are reviewing your financial situation, it could be best so you can assess family expenses, the debt, the assets, and your income. That may make you an effective manifestation of what kind of cash you could potentially afford to obtain. This will be also a good opportunity to think about exactly how much money you will be able to pay for from inside the month-to-month repayments, which is the one thing when deciding exactly how much you could borrow.

Look and you can evaluate mortgage models. Its also wise to check out varying mortgage provides and you will house loans-including repaired in the place of adjustable, as an example-and you can feet the decision about what helps make the really sense given your existing existence circumstances. It’s adviseable to contrast different regards to interest rates among loan providers to figure out and therefore bargain works best for you.

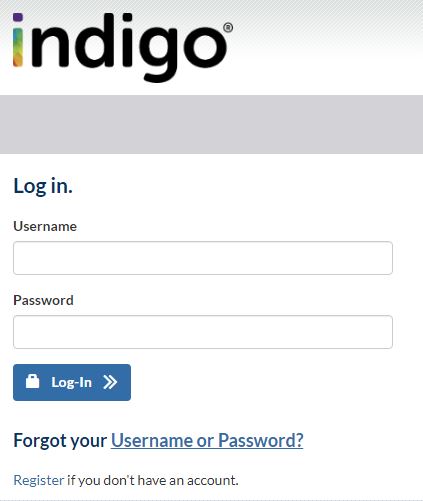

Fill out this new pre-approval software along with your bank. That’s where the borrowing from the bank and you can monetary pointers comes in useful.