Checks

- Household Examination The house Evaluation are bought and you may covered on your part, the buyer. The house Inspector you will strongly recommend after that checks, such as for instance a share examination otherwise roof evaluation, which happen to be often the Buyer’s obligations. Find out more on the Home inspections.

- Agent Graphic Check The brand new Representative symbolizing the buyer conducts an artwork review. Brand new findings are composed right up when you look at the a real estate agent Artwork Inspection Disclosure, and you will signed from the People and you will Manufacturers. So it assessment takes place at the same time once the Domestic Review.

- Lender Assessment Check If you’re taking out home financing, a loan provider appraisal will become necessary. You’ll pay the lender on appraisal, nevertheless dont sit-in the new assessment conference. Read more about Appraisals.

- Termite/Wood-Damaging Pest Evaluation For individuals who questioned a termite evaluation from the offer, this examination also needs to happens when you look at the first day. Providers always pay money for that it examination, and you will Consumers do not sit in. The fresh new pest company have a tendency to point a claim that is distributed to one another Consumers and you may Vendors.

Supplier Disclosures

Sellers typically offer various disclosures toward Consumer. A few of these disclosures establish the house, and tell you one issue defects or earlier facts. Find out more from the Provider Disclosures. Within Ca, extremely supplier disclosures are caused by the latest People when you look at the very first 7 days out-of escrow.

Should your home is based in a well planned people with a beneficial Citizen Organization, brand new Escrow Officer commonly purchase Homeowner Organization records, immediately after which post right to your, along with the First Term Statement.

Month A couple Financing Recognition or other Behavior

The next week regarding escrow is often the Decision-Making week: the financial institution renders its final choice to approval the loan, and you feedback every disclosures while making your final decision regarding purchasing the family.

Loan Recognition

Their lender’s underwriter can get request additional documents to have finally financing acceptance. Keep in touch with your loan manager, and you may continue steadily to bring people advice it demand.

Appraisal Abilities

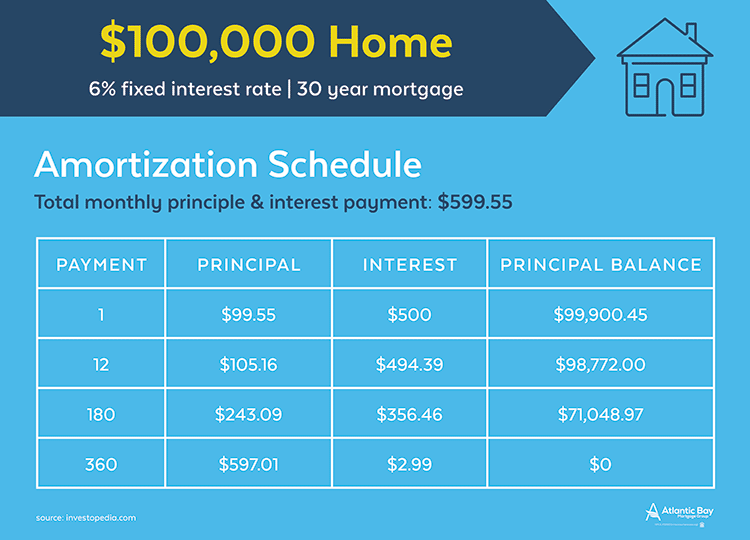

If financial gets the Appraisal Declaration, the seller could be notified when your appraisal has come when you look at the on worth. If the the house assessment well worth is gloomier than simply the purchase price, decisions have to be produced. Sometimes, the consumer will pay the essential difference between the fresh appraised really worth and you will the purchase price. Either, the vendor tend to lessen the cost. It could be a mix of both possibilities.

Disclosure Review

You are going to review the seller Disclosures, including the HOA papers. This can help you decide if we would like to read towards the acquisition of our home.

Resolve Requests

Your house inspector offers the fresh you with property Inspection Declaration. You could potentially submit an ask for Fixes into Provider, which happen to be fixes to get done because of the Seller prior to Personal away from Escrow. The seller is undertake or refute the new desires. The vendor may also offer a card for the Customer in the lieu away from repairs.

Day Three Contingency Launches and you will Resolve End

Buyers often indication Contingency Launches, to express the commitment to brand new Manufacturers to get our home. This happens when most of the checks try presented, disclosures try examined, repairs try discussed, and you may last mortgage approval try verified. In the Ca, brand new standard offer vocabulary need very contingencies to appear on Time 17. (This type of deadlines might be shortened in deal negotiation months.) Exactly how many months has vacations.

Times Five Last Facts

During the last times of the escrow timeline, every solutions was accomplished, and you will receipts was submitted to the buyer getting review. The buyer also performs a final Walk-Through, so you can check the latest fixes and you may make sure our home has been within the a similar position given that in the americash loans Reeltown event the give is made.

Mortgage Document Finalizing When you’re taking right out home financing, the brand new Escrow Officer often contact you to schedule that loan document finalizing having good Notary Societal. This will take set on escrow work environment, or you can possess a mobile notary come your way.

Since the loan are financed, while the offer action try submitted within Assessor’s Office, your fundamentally get keys to your brand-new household!

When you relocate, stay tuned for the s sent so you can naive home buyers. You’ll be able to hear about my the fresh citizen information.

For more information

Could you be thinking about purchasing a house? We have found a listing of my personal house customer services, and you may as well as here are a few which place to go to track down a mortgage. As usual, get in touch with myself having any questions.