Taxpayers can pick often itemized write-offs or the basic deduction, however, usually favor whatever contributes to a higher deduction, and that straight down taxation payable

It is also regularly assist fill steps step three and you can 4 off good W-cuatro function. This calculator is intended for use by You.S. residents. This new calculation will be based upon the 2024 tax mounts additionally the the brand new W-cuatro, which, in 2020, has already established the first major changes once the 1987.

From the You.S., the concept of personal income otherwise income always records the brand new in advance of-taxation number, entitled disgusting pay. Such as, simple fact is that style of income necessary toward mortgage programs, is employed to decide income tax supports, and that is made use of when you compare salaries. This is because it’s the brutal income figure in advance of other factors try used, such federal income tax, allowances, otherwise health insurance write-offs, all of these vary from the grapevine. However, relating to private financing, the greater amount of simple figure is actually after-income tax income (either described as disposable money otherwise net income) since it is brand new figure that is in fact disbursed. As an example, a person who lifestyle paycheck-to-income can also be calculate how much they’ve available to pay second month’s lease and you will costs by using the simply take-home-salary number.

Rates joined towards “Their Yearly Income (Salary)” must be the prior to-tax matter, and impact revealed for the “Last Salary” is the immediately after-income tax amount (and additionally write-offs).

It is vital to improve difference between bi-each week and you can semi-monthly, while they may sound equivalent at first. Into reason for that it calculator, bi-weekly costs exist another month (even when, oftentimes, you can use it in order to indicate double each week). As well as, good bi-weekly percentage volume builds a couple of way more paychecks per year (26 versus 24 to have semi-monthly). If you find yourself one towards the a bi-weekly fee plan will get a couple paychecks having ten weeks out of the year, they located about three paychecks to your left a couple months.

As a whole, group like to be paid back more often because of mental items, and companies would you like to pay shorter appear to considering the will cost you of the improved commission regularity. Certain claims has actually certain spend regularity requirements, however, government rules merely dictate that payment plan become predictable. A manager cannot shell out a worker bi-weekly one month, up coming month-to-month the next. As the a side mention, spend periods have no effect on taxation accountability.

More are not chosen choice will be “Unmarried,” “Hitched Filing As you,” and you will “Direct away from Household.” It will be easy to have a single individual to help you allege an alternative filing position. As an instance, an individual who was “Single” also can file because “Head away from House” or “Being qualified Widow” whether your standards try fulfilled. Considering this type of choice, you’ll be able having an excellent taxpayer to test their options and you may choose the submitting standing one causes minimum of income tax.

Write-offs normally straight down another person’s income tax accountability by lowering the total nonexempt earnings. The brand new write-offs try classified on the three inputs above.

They are write-offs that will not feel withheld by the manager but may feel deducted out-of nonexempt earnings, along with IRA contributions, education loan desire, accredited university fees, and you will education-associated fees as much as $4,000, etcetera

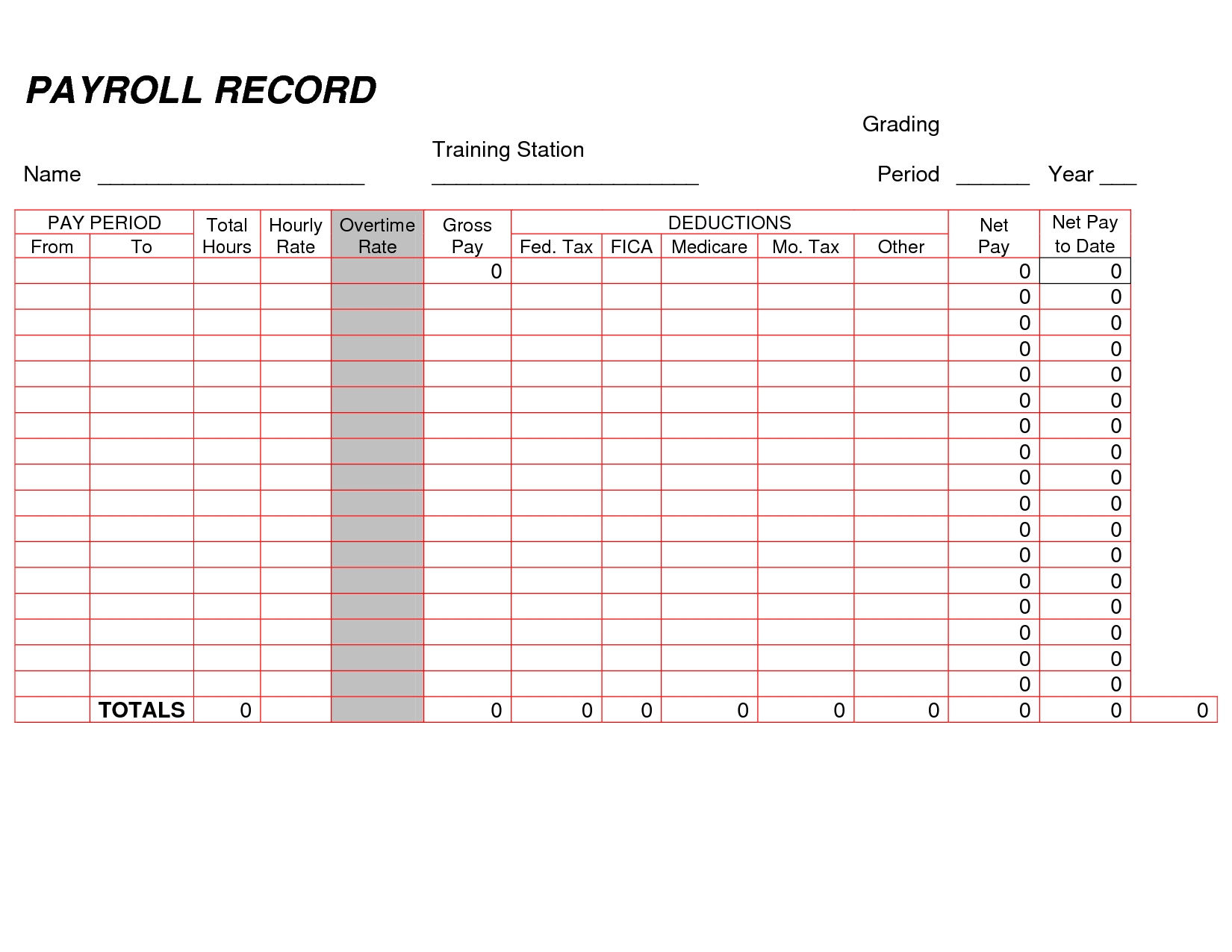

These are the deductions becoming withheld in the employee’s salary because of the the manager till the income will be paid, as well as 401k, the fresh new employee’s share of health insurance premium, health bank https://paydayloansconnecticut.com/canaan/ account (HSA) deductions, youngster support costs, relationship and you may uniform dues, an such like.

Speaking of expenditures into qualified facts, features, otherwise efforts and this can be subtracted off nonexempt money, together with qualified financial interest, county and you will regional tax along with sometimes assets or conversion fees up to $ten,000, charitable contributions, medical and you may dental expenses (more than ten% regarding modified gross income), etc. Just in case you avoid the use of itemized deductions, a fundamental deduction may be used. The standard deduction dollars amount was $fourteen,600 getting solitary domiciles and you will $31,200 to possess .