The greatest qualification requisite to notice when you look at the Tx is you can simply borrow 80% of one’s home’s joint loan-to-value. If you know an over-all ballpark in your home worth, your home loan harmony plus your the newest HELOC are unable to surpass 80% of this number.

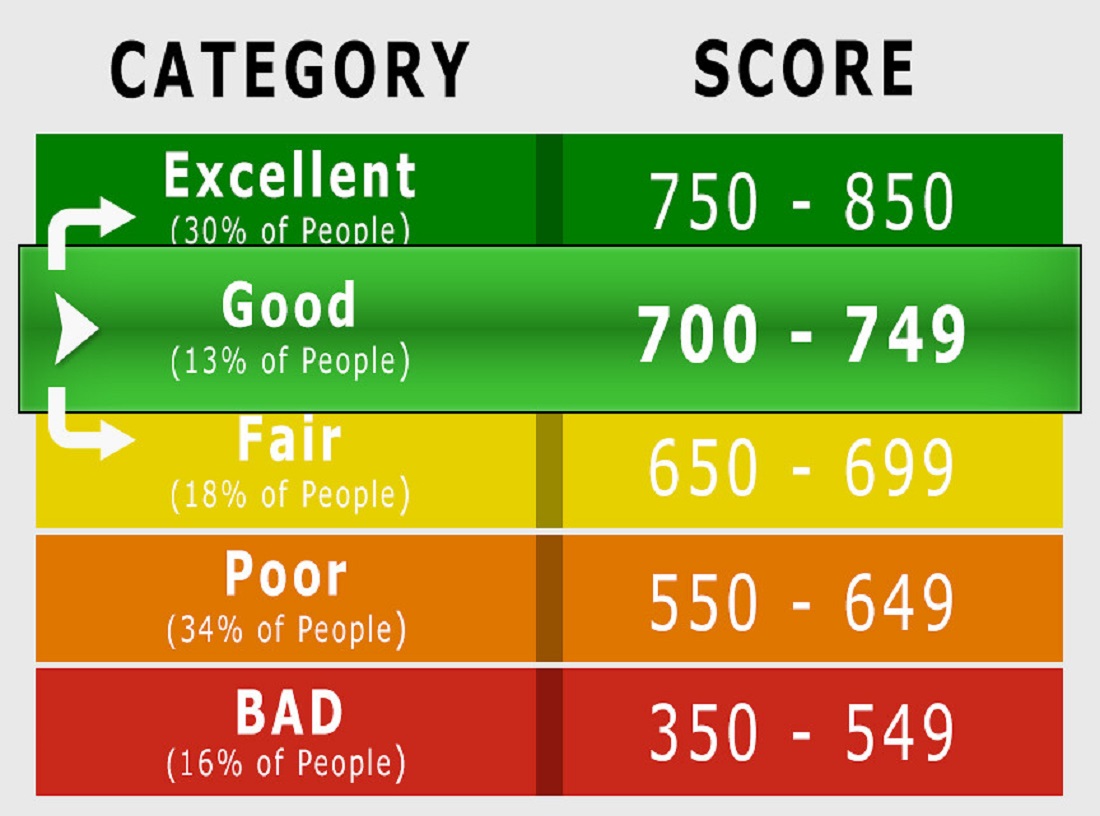

The lenders think about your individual credit rating when deciding your eligibility having a beneficial HELOC when you look at the Texas. For those who have a top credit history, possible qualify for a reduced price. A lesser credit rating function you can shell out increased interest rate.

Minimal credit history necessary to qualify for a beneficial HELOC varies because of the bank, states Moore. Generally, when you yourself have a credit rating out-of 700 or more and you will see almost every other conditions, such as a minimal debt-to-income ratio, you need to qualify for a lower life expectancy interest.

No matter what your credit rating are, its wise to comparison shop and you may compare multiple loan providers. In addition to other rates of interest, you may want to choose from some other cost name lengths. You are able to speak about repaired and you can varying price choices otherwise focus-merely costs.

How exactly to apply for a good HELOC when you look at the Tx

Trying to get an excellent HELOC when you look at the Tx starts with contrasting several lenders. You can constantly prequalify to see what sort of price and you will terms you will be eligible for. Then it is time for you to complete an official software. Be prepared to deliver the following the facts:

- Address verification

- ID

- Term, birthday, and Societal Security amount

- Company identity and you will target

- Shell out stubs, W-2, and/or tax returns

- Financial comments

- Assets goverment tax bill

- Mortgage statement

- Home insurance statement web page

Immediately following approved, the state of Colorado demands residents to wait no less than twelve months before closing. By doing this you have plenty of time to look at the HELOC terms and conditions and change your face if necessary. In those days, the lender may also acquisition an appraisal to confirm the value in your home.

What is the lowest HELOC rate into the Texas?

A reduced HELOC speed in Tx hinges on the debtor and you may the lender. Homeowners should always research rates and you will examine cost and you will charge between lenders to store the quintessential cash on their HELOCs.

What HELOC has got the large cost inside Texas?

HELOC prices are affected by fiscal conditions, https://paydayloansconnecticut.com/cannondale/ the latest homeowner’s individual financial history, plus the lenders on their own. No body bank can probably be said to obtain the highest prices in the Tx. To get rid of high interest rates, people should always rate store before choosing a lender.

What’s the latest mediocre HELOC rates inside Texas?

HELOC cost are influenced by the newest federal finance rates together with borrower’s credit score, and national and around the world economic climates. Because of this, costs vary each day, you would want to contrast lenders immediately after you might be ready to take out a great HELOC.

Will my Tx HELOC provides insurance rates standards?

A tx HELOC doesn’t need mortgage insurance rates because it’s not a classic mortgage. Its, as well, will necessary for traditional funds and you will FHA finance.

Perform one loan providers not provide HELOCs into the Colorado, and why not?

Given that Colorado towns and cities limitations about HELOCs may be used contained in this the state, particular loan providers may like to not provide HELOCs. Although not, even after county regulations, Texans can find HELOCs with lots of loan providers.

To steadfastly keep up the 100 % free solution getting users, LendEDU both get settlement whenever website subscribers simply click so you’re able to, get, or buy affairs looked towards the sitepensation may impact where & exactly how companies show up on this site. On the other hand, the publishers do not always review each business in virtually any industry.

Once the difference in brand new finance is just one %, this new homeowner would spend $6,480 alot more that have a somewhat higher level.