Choosing eligibility getting Oregon first-day family buyer applications is a vital step-in the home to get process. An issue to take on is the cost restrict for your county. Each state into the Oregon features another type of limitation, so it’s important to see this informative article prior to beginning your pursuit. Another type of issue is being qualified income into the limit home earnings restrict place by the each system.

This type of limitations vary dependent on factors including friends dimensions and you can place. It’s essential to fulfill this type of criteria to-be entitled to direction apps such advance payment guidance or features offered by the official regarding Oregon. Of the wisdom these requirements upfront, you might know if your be considered and take benefit of the latest available information that can help build your imagine homeownership an effective fact.

About to shop for a house in Oregon, it is important to understand cost constraints place each county. This type of limits dictate the utmost price you could buy a good possessions nevertheless qualify for very first-date household visitors software.

The price maximum varies from one county to some other, based on payday loans Minnesota factors particularly area and market criteria. To determine the price maximum for the specific county, you can travel to your website of the Oregon Casing and you can Neighborhood Services (OHCS) or get in touch with the work environment individually. They supply detailed information regarding the newest limits inside the for each county, ensuring that you may have appropriate or over-to-big date guidance before you start your residence look.

Understand that these price restrictions are meant to help very first-time home buyers that has minimal savings. Of the getting throughout these constraints, you enhance your probability of being qualified to own deposit advice programs or other tips designed to build homeownership a great deal more accessible. Thus ahead of starting your property to shop for journey, take time so you can get to know the price limitation specific on state!

When trying to get first-date domestic client programs into the Oregon, it’s important to determine if you meet with the limit household earnings limit. For each and every system has its own income requirements, which will vary based on points including family size and you can place. To find out if your earnings qualifies, start by figuring the full domestic money.

Including all the sources of money out-of all users living less than you to rooftop. After you’ve this contour, contrast they towards the specific money limits place of the program you are searching for. Understand that such limitations may vary according to for which you bundle to buy a home within Oregon. Of the understanding and appointment the fresh being qualified income standards, you could status on your own well to take benefit of Oregon’s basic-go out family buyer programs and make your perfect from homeownership a reality

App Techniques for Oregon Thread Home-based System

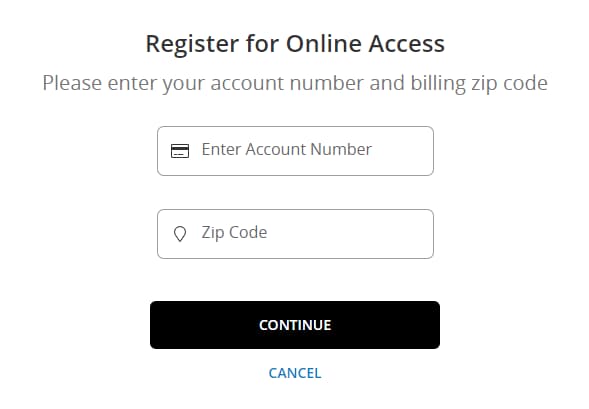

To start, you will need to get a hold of a medication financial who will assist you through the software procedures. They let determine if you meet the earnings and purchase speed restrictions place from the program. Once you’ve found a lender, they will certainly direct you towards completing the necessary papers and you will meeting one requisite documents, instance evidence of money and you may personality. Once distribution the job, it might be reviewed because of the Oregon Houses and you can Community Attributes (OHCS) to evaluate your own qualifications having recommendations. In the event that acknowledged, you get a letter detailing 2nd strategies and any extra conditions before closing on the brand new home.

Almost every other Resources to have First-Go out Homebuyers for the Oregon

Whenever you are a first-go out house client in Oregon, there are various resources accessible to help make your imagine homeownership a real possibility. As well as the certain county apps stated before, of many metropolises and areas provide their particular earliest-time household client software and has. Like, Portland has several efforts intended for assisting low- in order to moderate-money anybody and you can family that have down-payment assistance and you may reasonable housing choice. Also, Salem and Eugene features their programs built to let citizens reach homeownership.