What’s the most HELOC Count? Self-help guide to HELOC Restrictions

A home security credit line, otherwise HELOC, lets property owners to view dollars by the borrowing contrary to the guarantee they possess in their residential property.

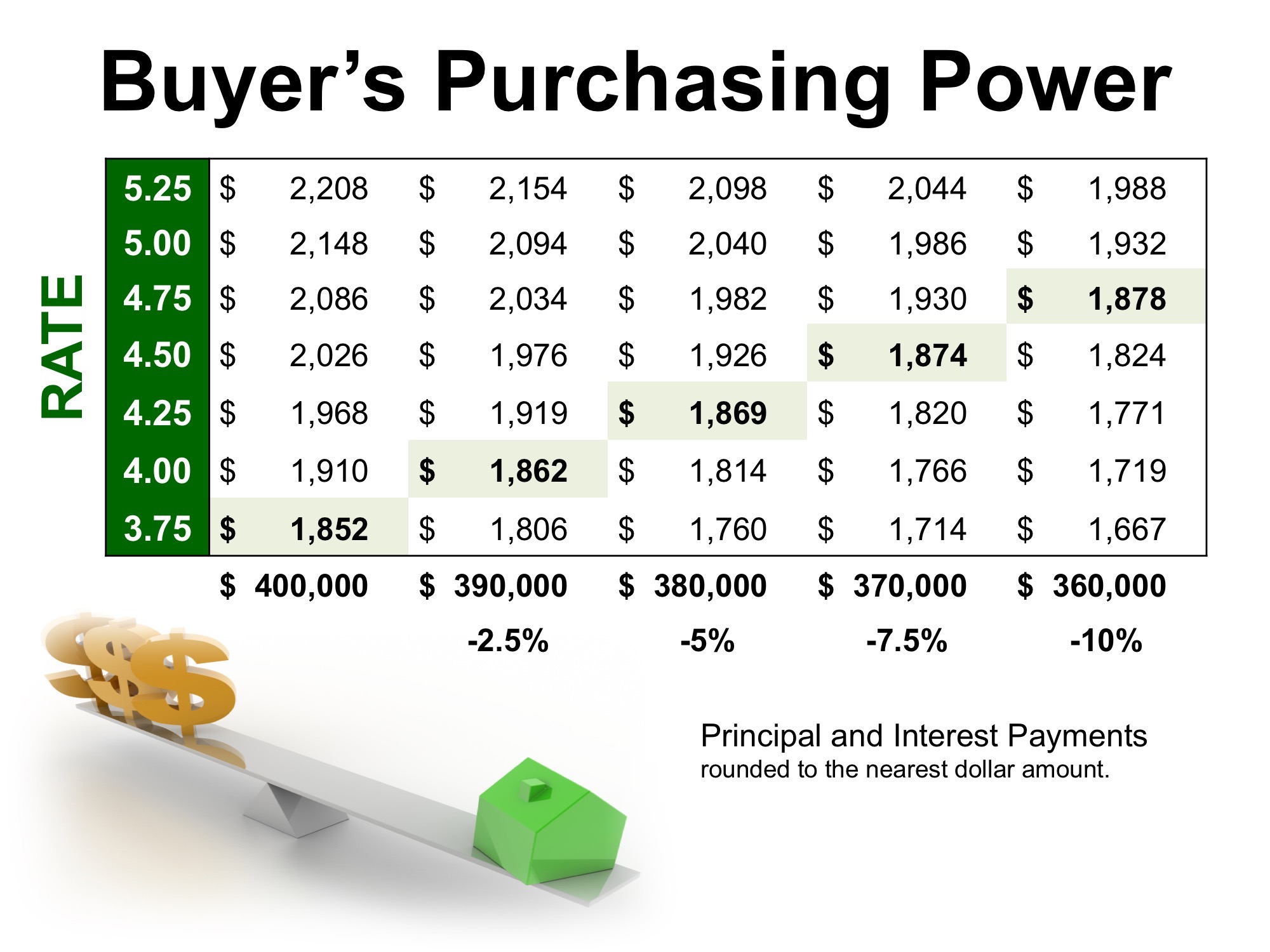

The most HELOC count you could obtain depends upon the new value of your home, everything you own on your current mortgage, and you will exactly what part of the house well worth your bank usually assist you cash out. Most loan providers enable you to acquire around 85% many goes high – up to 90% or even 100%.

- HELOC limitations

- How restrictions are set

- What affects your HELOC number

- Choice in order to a good HELOC

- HELOC restrictions FAQ

HELOC financing limitations

Mortgage lenders determine the mortgage restrict on a HELOC through providing a portion of the home’s well worth since your borrowing limit.

The utmost HELOC amount was found as a percentage (always 85%) which is short for the amount you might borrow secured on your home during the total – as well as your HELOC and you may whatever you own in your existing home loan. This is exactly labeled as your own combined mortgage-to-really worth (CLTV).

Just how your limitation HELOC count is decided

The most loan amount getting property security credit line varies because of the financial. (more…)