Whenever Cost Was High, Borrowers Which Look around Save yourself More

As the mortgage costs are greater than in recent times, homeowners could easily save yourself $600-$1,2 hundred annually by applying having mortgages regarding several lenders, centered on new research by the Freddie Mac computer.

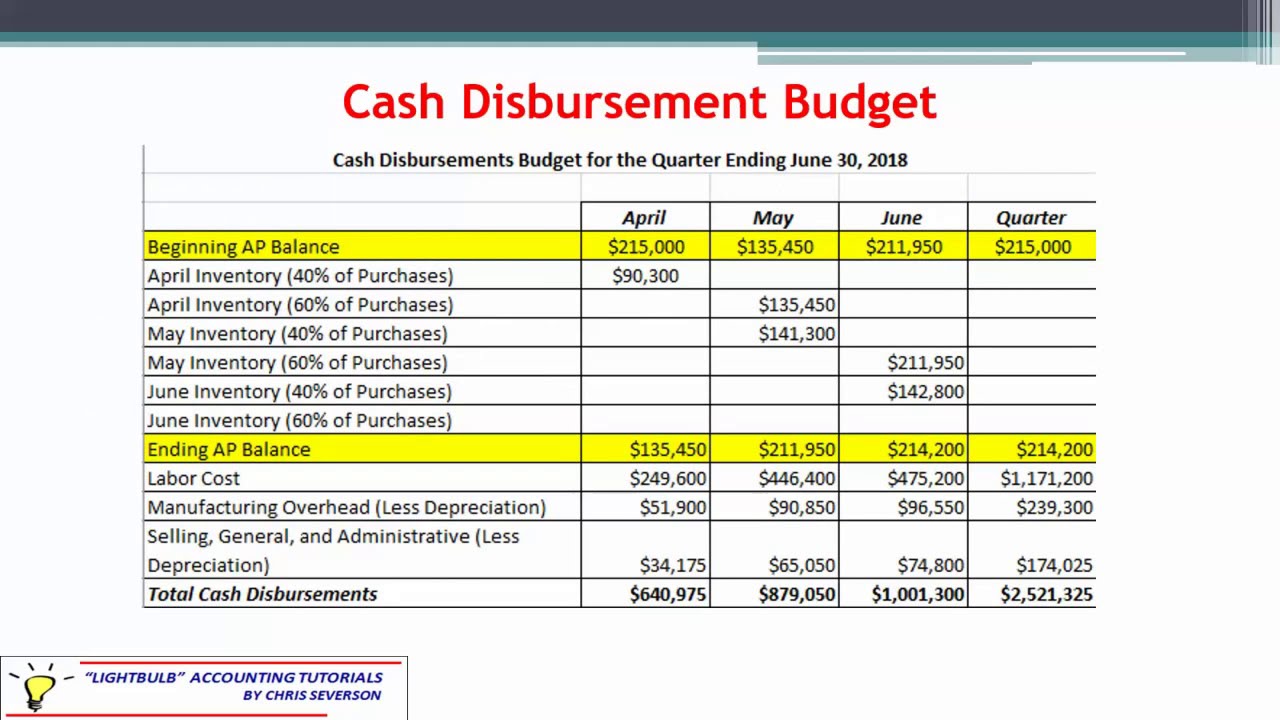

Knowing exactly how, Freddie Mac scientists utilized the organization’s Financing Equipment Advisor (LPA) unit to take on the latest each day dispersion from mortgage rates of interest toward home loan applications for the very same debtor users throughout the years.

Mortgage Speed Dispersion More than doubled for the 2022

Having fun with LPA study, experts can see the new dispersion (or variability) inside mortgage cost for the very same financial programs published to Freddie Mac computer because of the more lenders on a single go out. To put it differently: if there is a broader array of home loan pricing given, similar individuals will get located significantly additional costs according to the bank.

For-instance, between 2010 and you can 2021, whenever home loan prices peaked at the 5.21%, individuals which used that have a couple of other loan providers reduced the home loan rates from the normally 10 foundation things. (more…)