Like finance has actually an introductory age of reduced, fixed cost, following it will vary, based on a modification index

Find out about the mortgage procedure with these films library to possess homeowners. Whether you’re an initial-date homebuyer, thinking of moving an alternative family, otherwise have to refinance your existing traditional otherwise FHA home loan, the fresh new FHA loan program enables you to get a property that have a low advance payment and flexible direction.

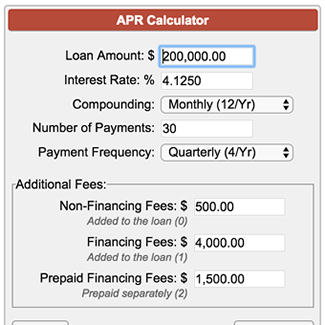

New annual percentage rate ‘s the cost of borrowing money from the financial institution, revealed as the a portion of the home loan count. The Annual percentage rate boasts the interest rate along with other fees which can be paid down over the longevity of the mortgage.

An enthusiastic amortized mortgage boasts typical periodic payments from each other principal and you may attention, which might be paid off within the name of one’s loan. Amortization times detail the new monthly premiums and exactly how most of for each fee goes to principal and attention.

All money you have made over the season in the earnings, salary, tips, bonuses, commissions, and you can overtime amount to your own annual income. In the example of mortgage programs, loan providers primarily work at income courtesy wages otherwise income.

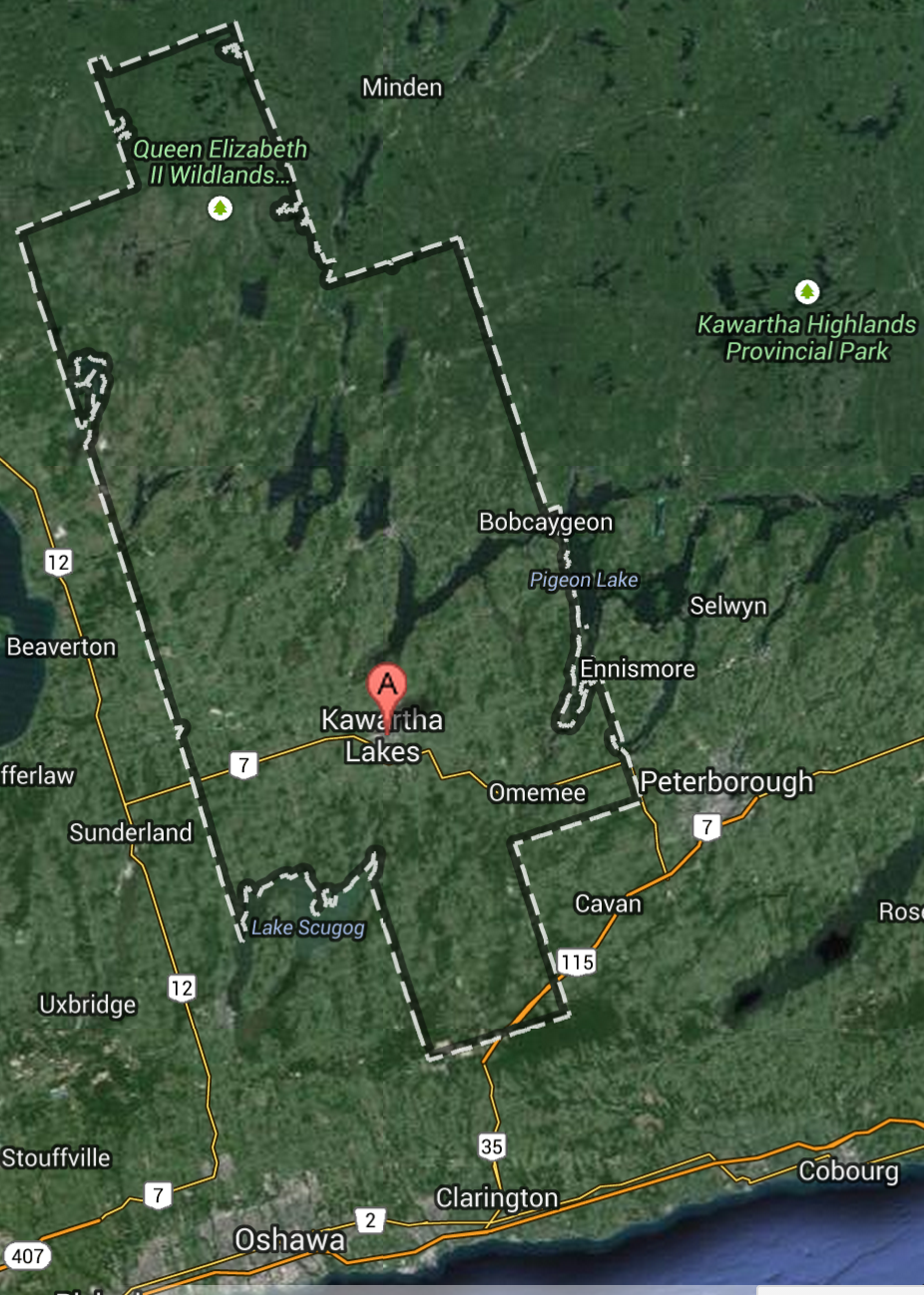

After you submit an application for a mortgage, your own lender will require you to definitely an assessment is completed towards the property. This step pertains to examining the worth of our home by way of an examination and also by evaluating they so you can similar real estate in the town. (more…)