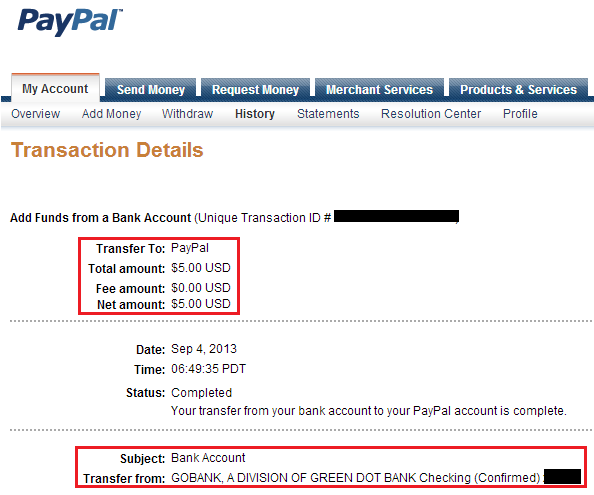

What are a guaranteed mortgage which have LendingTree

A guaranteed mortgage may possibly not be the best option for everyone. Maybe not keeping up with your instalments can tank your credit rating, and also to build some thing worse, you are able to get rid of their equity.

Looser requirements. Because secured finance are usually more straightforward to be eligible for, they might be a good idea when you have fair or bad credit.

A lot less prominent. You may possibly have a hard time searching for a lender, credit connection otherwise on line bank which provides secured finance.

Write to us what you need.

Discover your low rates of the experiencing America’s largest circle regarding loan providers. You can have multiple offers within a few minutes, and no impact on the credit rating.

Examine and win.

See what loans you might be eligible for and you will with the fresh new most effective recognition potential. Before you go to use, we shall be present each step of your ways.

Trying to get secured loans having bad credit

For those who have rocky credit, you can even alter your rating before applying while making it likely to be the financial institution usually accept you. (more…)