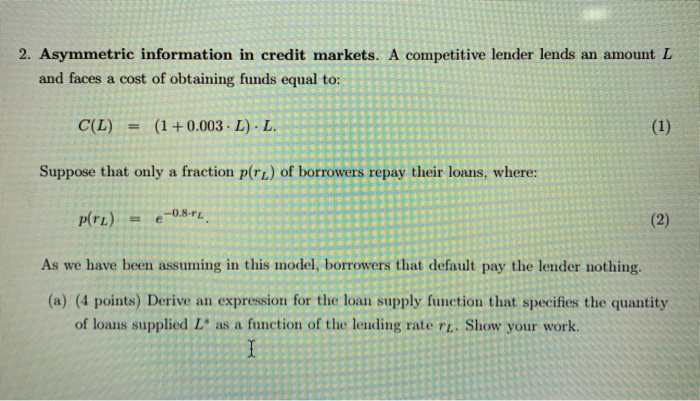

Your own 2019 Irs Mode 1040 Agenda C should be provided to establish the applied-to have PPP loan amount

Income Cover System Ideas on how to Determine Limitation Mortgage Wide variety To have Very first Mark PPP Finance And you can Just what Paperwork To add From the Organization Method of

The small Providers Management (SBA), into the appointment for the Agencies of Treasury, offers that it current advice to greatly help businesses when you look at the calculating its payroll will cost you (and related paperwork that is required to support for each and every set out of data) getting purposes of determining as much a first Mark Paycheck Coverage System (PPP) mortgage for every form of company.

Individuals and you will loan providers may have confidence in the newest guidance given within this file as the SBA’s interpretation of your CARES Work, the commercial Assistance Act, and the Income Cover Program Meantime Latest Laws and regulations. New You.S. bodies cannot issue lender PPP steps you to conform to it suggestions in order to the fresh new PPP Interim Last Regulations and any after that rulemaking ultimately at that time the action is removed.

The fresh recommendations identifies payroll can cost you with the calendar year 2019 since new site several months to have payroll will set you back familiar with estimate financing amounts. But not, individuals are allowed to utilize payroll will cost you out-of sometimes season 2019 otherwise twelve months 2020 because of their Very first Mark PPP Financing matter computation.2 Documentation, together with Irs versions, have to be offered with the chose site months. (more…)