Advantages and disadvantages from money spent mortgages

Protecting that loan that have lower local rental possessions interest levels will be fairly easy. Stick to this action-by-step help guide to understand the qualifying techniques and just how current mortgage rates getting money spent can affect your own borrowing costs.

When buying accommodations property, you should have use of some of the same financial support options just like the you might getting a primary house otherwise the next mortgage loan loan. However, investors features several alternative lending options to consider.

For every bank will offer additional money spent financial pricing, so compare various proposes to ensure you get the cheapest price offered.

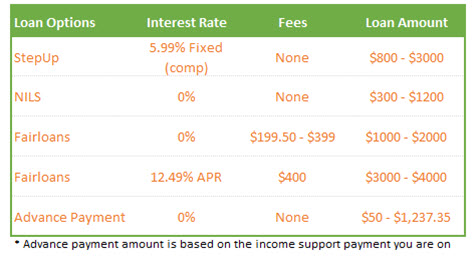

As compared to mortgage loans to have number 1 residences, money spent loans has actually their set of benefits and drawbacks. Let me reveal a summary of a number of the main masters and you will drawbacks.

- Make local rental income: You could potentially acquire purchasing accommodations possessions and make use of local rental money regarding tenants to fund home loan repayments when you’re building money using assets admiration.

- Highest mortgage restrictions: A house dealers is borrow over that have traditional fund. Jumbo financing commonly meet or exceed $one million, permitting the purchase out of higher-end features with high local rental income potential.

- Zero number one home criteria: In lieu of government-backed financing, money spent money don’t need you to are now living in the house, offering people way more independency. (more…)