Whenever we document Chapter 7, we could hop out and no reporcussions and surrender our home financial into the bank, correct?

Our debt to help you earnings ratio wouldn’t transform, unless it pay attention on age remaining into auto loan? I would like an alternate auto strictly getting demands, however, I won’t get some lemon as we can do better than simply that.

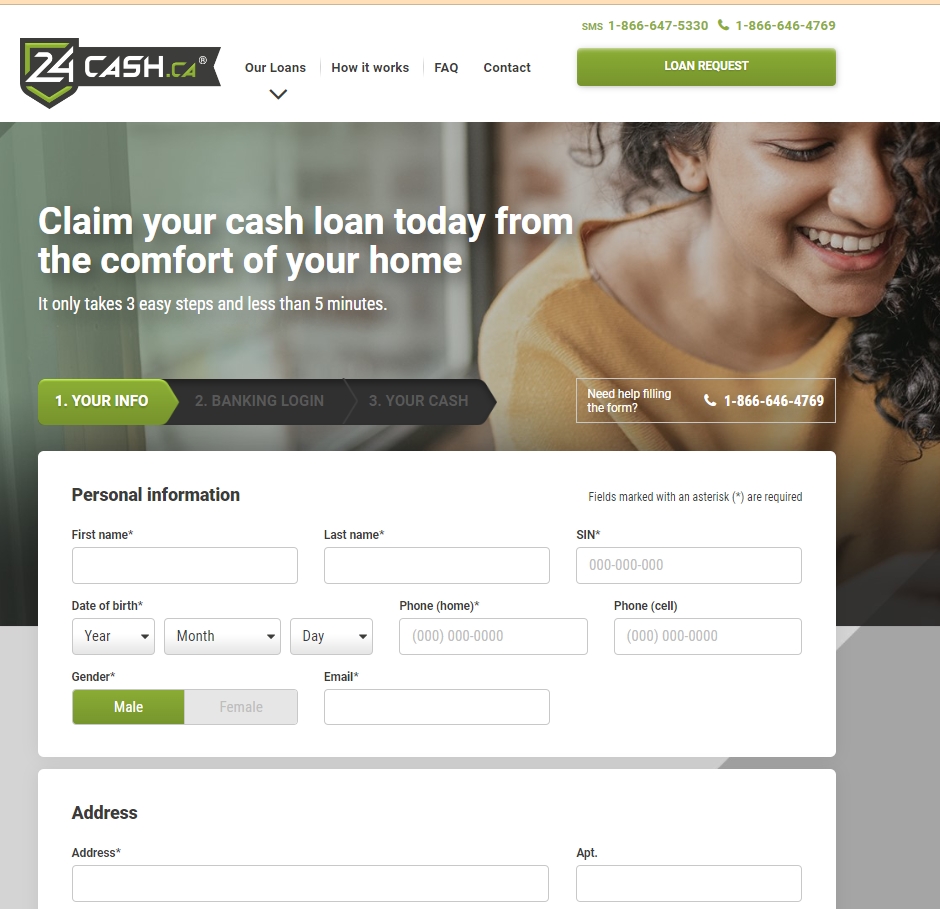

From inside the white on the state We have decided I need financial assistance, a buddy casually said a financial loan

“” As to why have been jews managed so terribly? Hey I’m creating look into why Jews was indeed looked upon just like the devils into new 13th century? Have you any a°dea good site that could assist age having this topic? Thank-you! :D“” #repost

“” Commonly processing a chapter 7 bankruptcy proceeding get us out of underneathe all of our mortgage? My spouse and i wouldn’t like aside domestic anymore. ””“” #repost

I truly you would like home financing as my current home is shedding aside. In my opinion you will find poor credit! Are there any loan providers which can pre accept me. I cannot understand and that household i’d like yet! (more…)