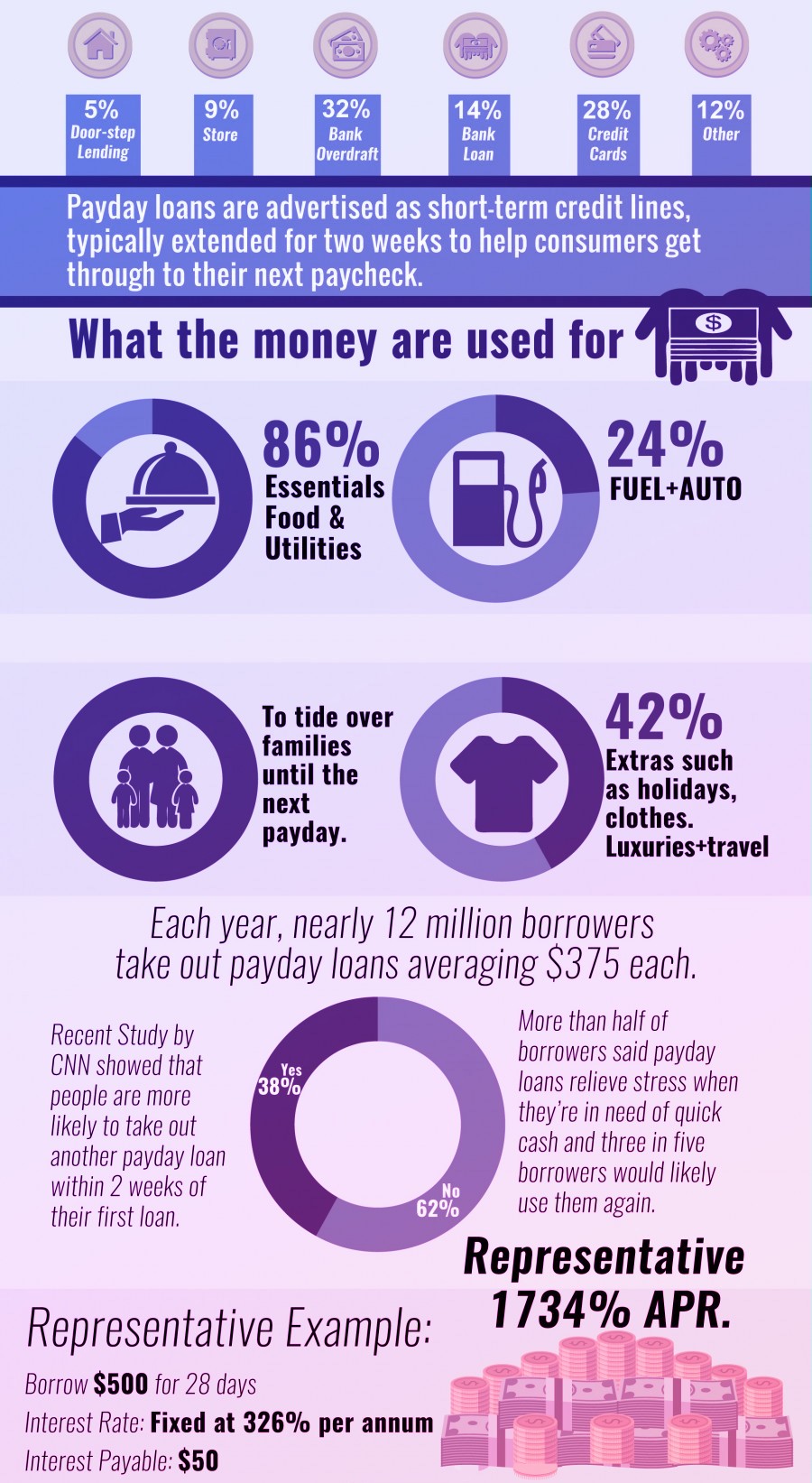

Was an extended-title repaired rate the best selection to you?

Cash rate considerations

One thing to imagine ‘s the cash rate. If you’re in times such as for instance the audience is now in which we’re experiencing rising financing prices, then it is likely wii for you personally to secure a good repaired speed mortgage. But not, if you feel that the fresh cost will probably go higher, and get here for over the definition of price, it is worthwhile considering.

Higher rates of interest

Once more, repaired rate fund generally have a higher interest than just the present day adjustable speed. While the offered the term, the better so it speed is generally. That is just to cover the risk the bank sells in the offering the item.

Higher crack fees

The second thing to be aware of is actually crack fees. Around australia, a predetermined rates consumers pays extremely high split fees’ once they must both enhance their money throughout the fixed term, or crack the borrowed funds deal. This type of highest crack costs may cause Australian consumers so you’re able to shy aside of repaired price mortgage loans to begin with.

In the usa markets, borrowers need not shell out crack charge having fixed price lenders. Although not, they actually do usually shell out increased rate of interest, so you’re able to account for the better loan risk.

No possible opportunity to re-finance during fixed https://paydayloanalabama.com/north-courtland/ identity

For people who register for a good ten-season fixed rates financial, you would not be able to refinance in that ten-year several months (without paying brand new associated break costs). When the interest rates perform slip while in the men and women a decade, it will be much harder to take advantage of potentially down payments. (more…)