Have more unanswered issues? Check out related inquiries and you will solutions that can help

Repaying your house loan smaller are a sensible monetary decision that gives individuals masters, and interest coupons, reduced economic chance, and you can enhanced return on the investment. Because of the implementing designed actions you to take your book points under consideration, you could potentially speed their go to loans-free property control. Think of, most of the bit counts because it the adds to the long-title economic well-becoming, moving one to a better coming regarding the market.

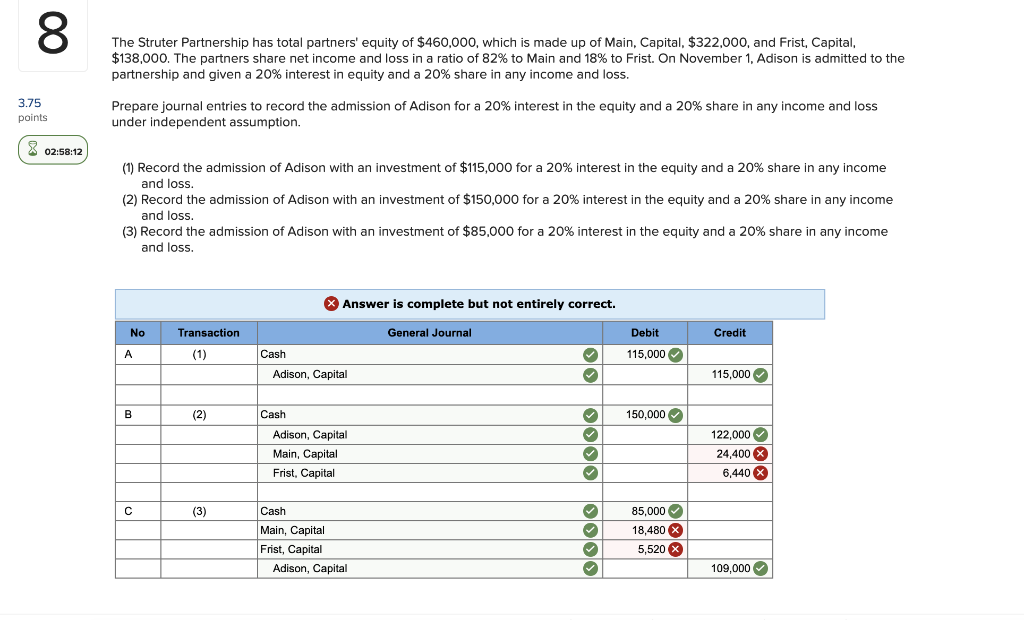

Whenever is best time to spend additional on your own thread?

The best time to expend most on your own thread is actually the first 10 or more numerous years of the borrowed funds label. Finance companies framework the brand new repayments to make sure that attention is actually weighted a great deal more in order to the initial half your house loan name. This means that, before everything else, from the 80% of your month-to-month fees count goes only to pay the attract in just 20% towards financing matter. For that reason, over the years, and by the end of the mortgage identity, you’re using reduced for the desire and towards equity in your home. (more…)