Buy your first house with the help of the newest ASP strategy

You could real time the life span you would like within your house. To possess Viivi, 27, their particular home is a getaway from the anxieties of lifestyle. Viivi realised their own think of to find a home by the preserving daily within the a keen ASP membership.

- Coupons account

- Individual

- Offers and you will financial investments

- Offers account

- Get your very first household early having house saver’s bonus

Easy preserving into a different domestic short amounts seem sensible

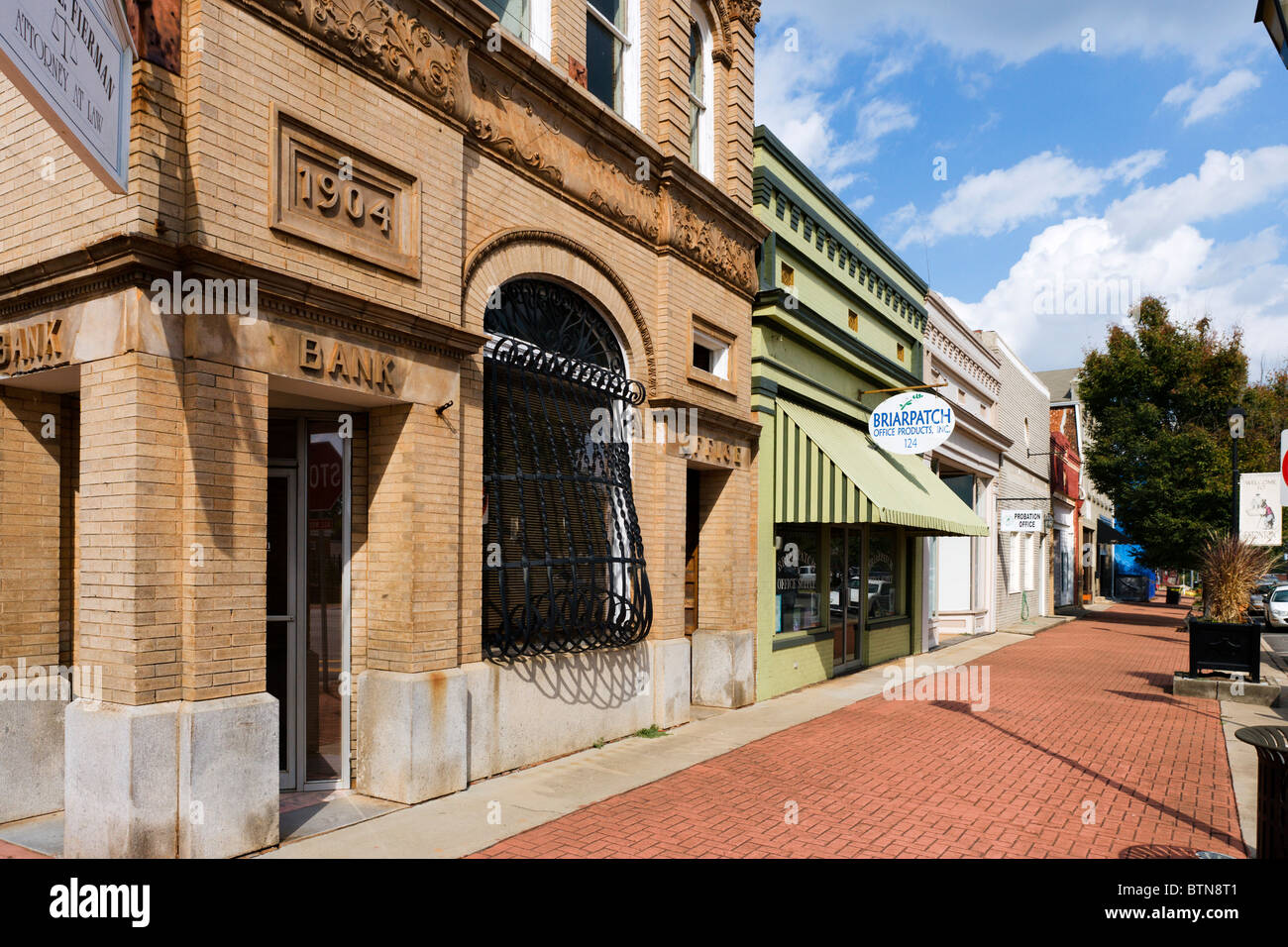

A-two-storey terraced house during the Porvoo has happier the newest customers. Viivi, twenty seven, keeps moved in the together with her partner along with her puppy named Sulo. So it quick family unit members been able to realise its dream of purchasing a property with the help of normal rescuing.

Viivi already been saving to your property saver’s added bonus appeal account, popularly known as an ASP account, whenever she turned into 18 and went away from their unique parents’ domestic. Their financial recommended one to she cut towards a keen ASP account, which Viivi imagine are sensible: I might at some point need it my very own household in the course of time otherwise later.

You could real time the life span you need in your house

Viivi has sluggish days with coffee-and break fast on serenity and you can quiet from her very own family. She functions from your home occasionally, so it’s crucial you to their unique home is each other cosy and you will practical. Among the many a couple of bed rooms are a visitor rooms she spends since the her home office. (more…)