Difficult Comparison Between Car loans and you can Rentals

If you decide you don’t such as the auto or if perhaps you cannot spend the money for money, it could charge a fee. You will likely become stuck that have several thousand dollars in early termination fees and penalties should you get out of a rent early-and they’ll be due simultaneously. Those charges you may equivalent the amount of new lease for the entire name.

With exclusions, eg professional window tinting, you need to render the vehicle back in as it kept this new showroom reputation, without usual damage, and you can set up like it is actually after you leased it.

You might be nonetheless with the link to own expendable things eg rims, and that’s more costly to change towards a far greater-supplied vehicle that have advanced tires.

You may have to shell out a fee after you submit the car at the conclusion of the latest rent.

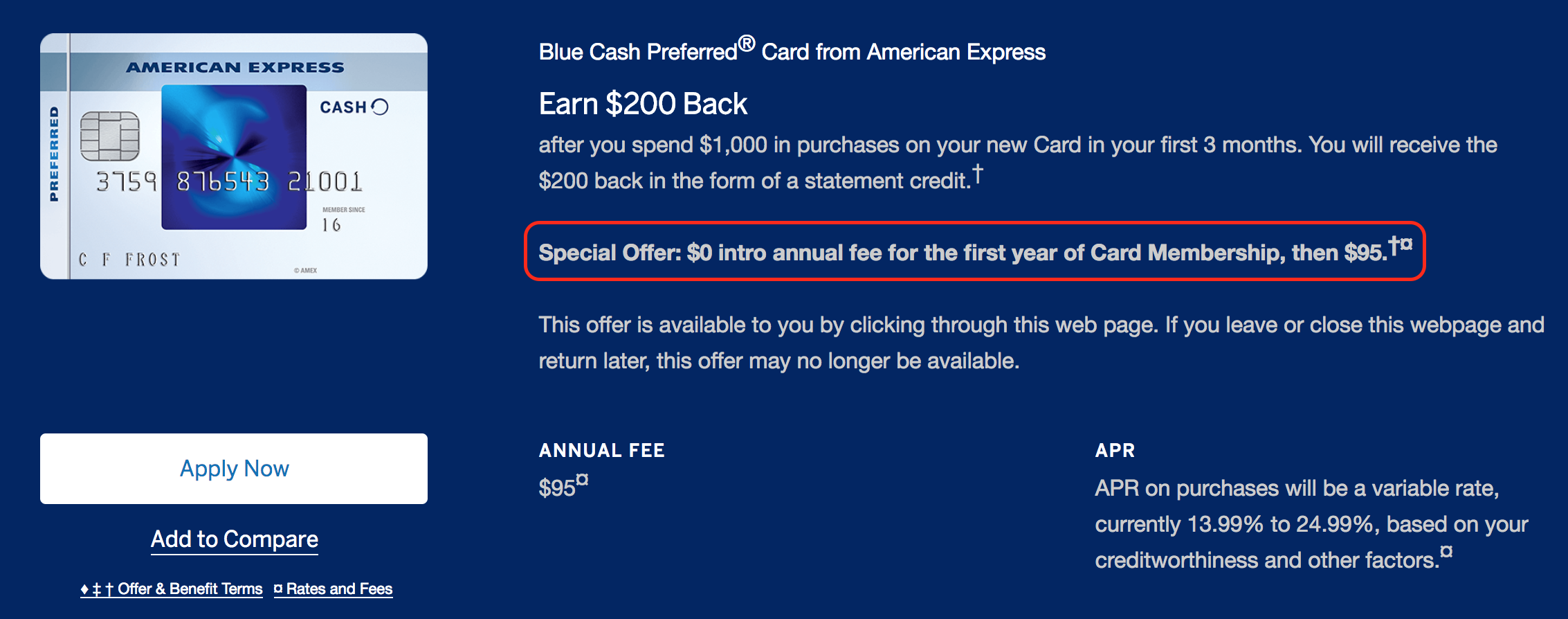

An alternative choice to Long Car and truck loans

Specific automobile buyers choose expanded-name auto loans regarding six to eight many years locate an excellent down payment. However, a lot of time finance is risky, that customers will dsicover local rental to get a far greater alternative.

Prolonged money allow easy to get inverted-after you owe more the vehicle is definitely worth-and start to become that way for a long period. If you want to eliminate the car early on or if perhaps it is shed or taken, the trade-during the, selling, or insurance coverage worthy of is likely to be lower than you continue to owe.

Taking out fully much time-name money and you will trade in early leaves your purchasing therefore far in finance costs in contrast to prominent that you will be much better out of leasing. If you can’t pay-off the real difference towards an enthusiastic upside-off financing, you might commonly move the quantity you continue to are obligated to pay with the a good new mortgage. But you get financing the the fresh new automobile and you will your whole old vehicles. (more…)