But it is one you must pay back alongside the typical monthly home loan repayments

Did you know millions of Americans are eligible to own good home loan no down payment? And this nearly all homeowners will get one having a little down payment out-of only step 3.0% otherwise 3.5%? Zero? Avoid being embarrassed for folks who did not know; it is a complicated thing. You should be ready to discover more — then take advantage.

You are suspicious regarding the mortgage loans with a no otherwise reduced down payment. Would not those individuals come from dubious, predatory loan providers who’re out to mine you? Zero! Zero-down mortgage apps was supported by government entities, and more than low down commission fund is backed by new FHA, Federal national mortgage association and you will Freddie Mac.

People federal businesses and you may organizations merely make sure an integral part of the mortgage, and you’ll be borrowing from the bank of a private organization. But the most from mortgage lenders promote specific otherwise all of the of them lower-or-zero-off money — also well-known brands and you will highly reputable of those, in order to choose one you will be comfortable with.

Are step 3% off an excessive amount of?

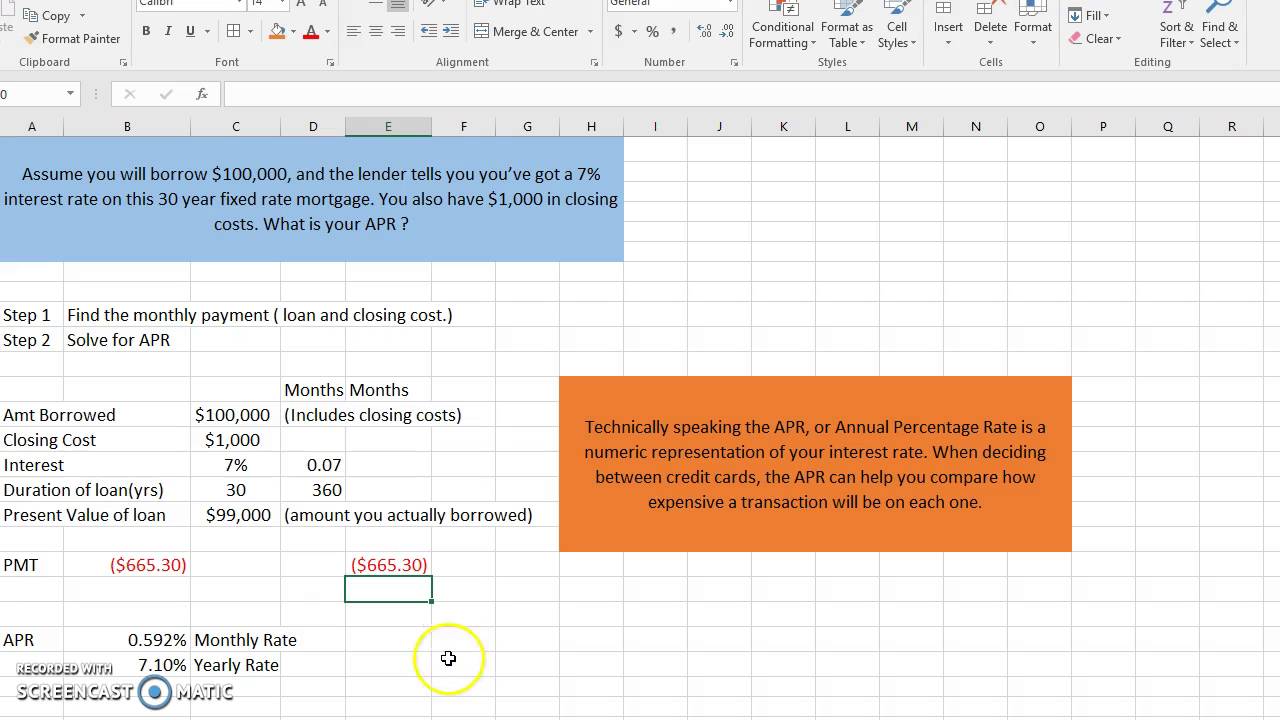

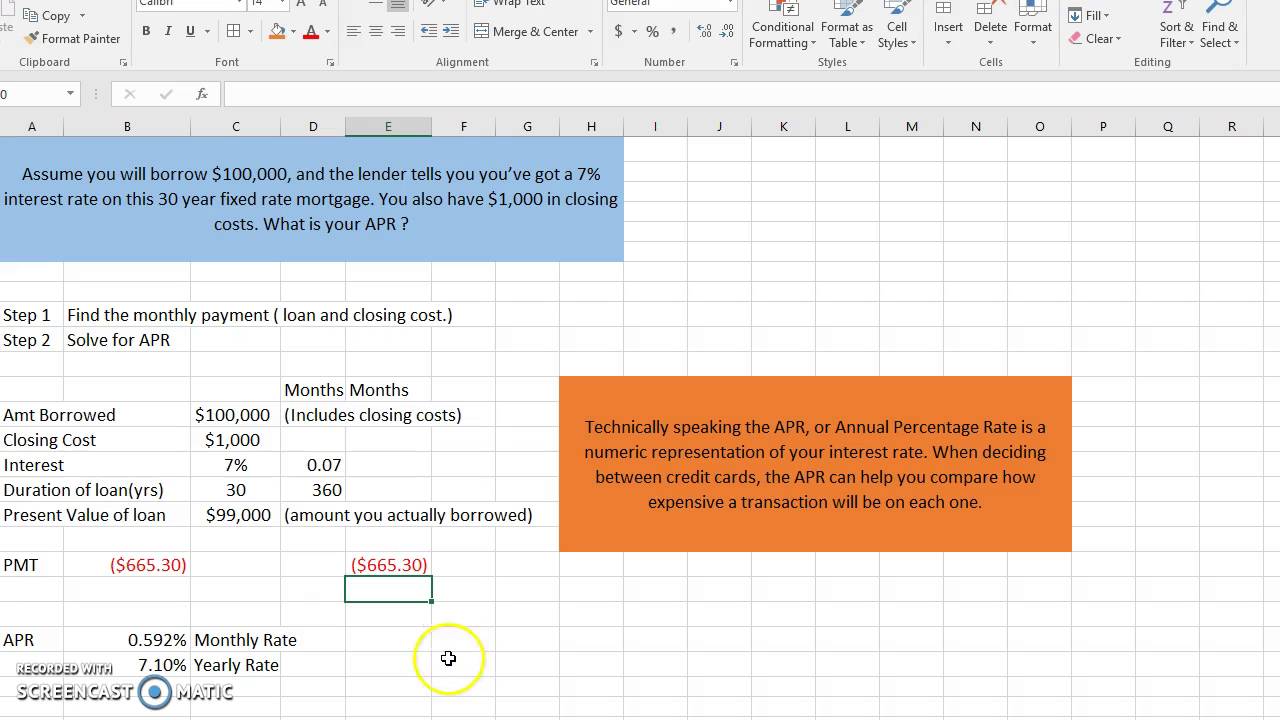

If you are borrowing from the bank $100,000, $2 hundred,000 or at least alot more, also good step 3% downpayment can seem a hopeless dream. (more…)