Towards $step 1,000 Desired Incentive render, $500 was paid personally from the Education loan Coordinator through Giftly

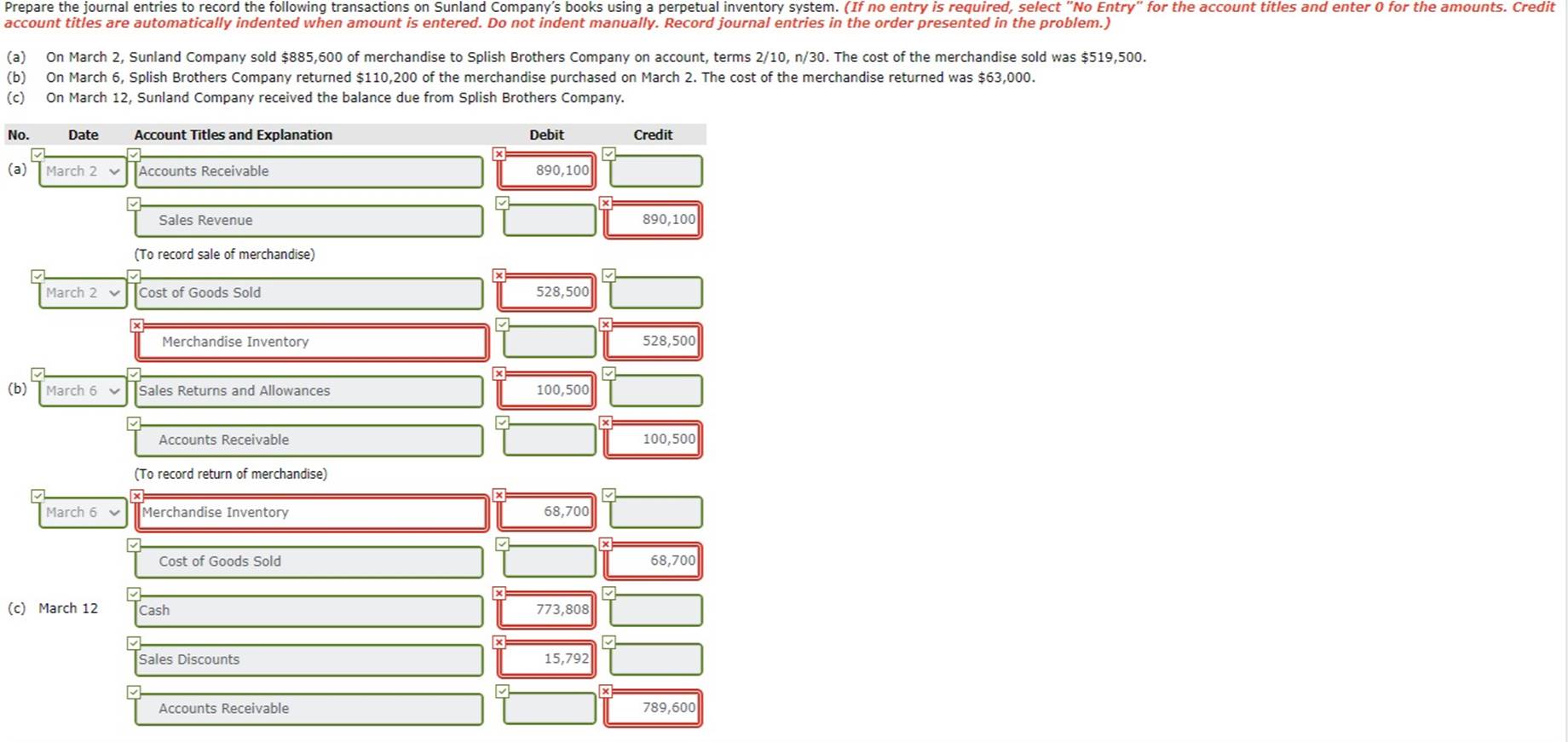

Bank and you will Incentive disclosure

This is exactly An advertising. You aren’t Required to Make Payment Or take One Other Action As a result To this Offer.

Earnest: $1,000 having $100K or more, $2 hundred getting $50K to help you $. Getting Serious, for many who refinance $100,000 or higher by this webpages, $five hundred of $1,000 dollars extra exists privately by the Student loan Planner. Price assortment a lot more than comes with elective 0.25% Auto Shell out discount.

The reduced rates are merely available for all of our most credit accredited consumers and you may contain the

Terms and conditions apply. So you can be eligible for it Earnest Bonus give: 1) you should not already end up being an earnest buyer, or have obtained the benefit previously, 2) you should fill in a finished education loan refinancing application from the appointed Student loan Coordinator link; 3) you ought to provide a valid email and a valid checking account count into the application procedure; and you will cuatro) the loan have to be completely disbursed. (more…)