Your couldn’t utilize this brand of financial getting an extra house, money spent, or industrial a house – only family buy fund having first houses.

This new FHA commonly ensure mortgages when it comes to number 1 quarters. There is absolutely no demands you have to feel a primary-date customer to utilize the fresh new FHA loan system.

Most other reasonable-down-commission mortgage apps have unique qualification requirements. Many are simply for those with lower, low, or moderate earnings. Otherwise they are available to only certain teams.

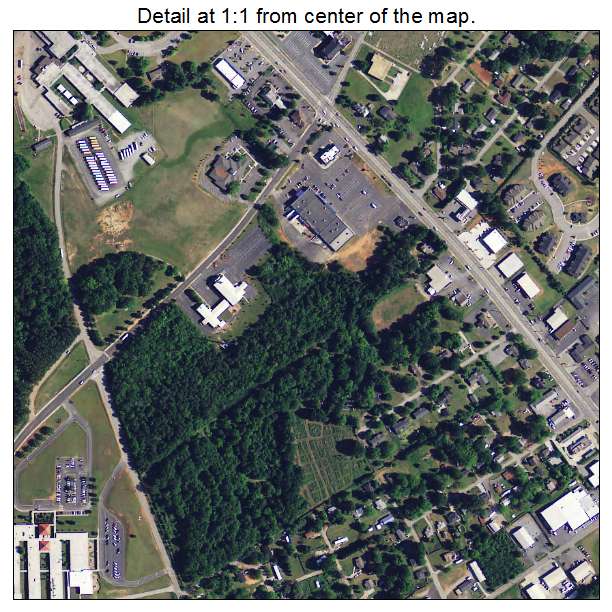

The new USDA Rural Creativity financing and lets 100% investment, however the system means you to pick for the a selected rural area and you may imposes money limitations, too.

For most people, FHA mortgage loans need a 3.5% advance payment. This will make this new FHA mortgage probably one of the most easy home loan sizes readily available all over the country.

Your own deposit money is a https://elitecashadvance.com/payday-loans-wa/ gift from a family member, boss, charity, otherwise bodies homebuyer program. Recently, brand new FHA features also began allowing presents from personal friends’ which have a distinctly discussed and you will recorded need for the latest borrower.

FHA fund ability a few of the most flexible and you will flexible credit conditions of any readily available mortgage sorts of. Having an FHA-recognized mortgage, you don’t have best borrowing.

In reality, brand new FHA explicitly teaches mortgage brokers to look at a borrower’s over credit history – besides remote cases of crappy economic luck or a periodic late fee.

This is because FHA doesn’t incorporate risk-depending surcharges having things such as straight down fico scores, higher mortgage-to-worth ratios (LTV), otherwise apartments and you may are built house.

This doesn’t mean you’re going to be considered. But consumers that have an excellent banged-up background have a much best chance of taking loan acceptance thru brand new FHA than many other loan selection.

Whether or not you’ve been turned-down to other types of credit, instance a car loan, bank card, or any other mortgage system, an FHA-recognized loan can get discover the entranceway so you’re able to homeownership for you.

FHA rates are usually less than those of traditional fund for people in the same borrowing from the bank bucket

FHA loans can be more pricey, or cheaper, than other mortgage sizes. The brand new much time-identity price of an enthusiastic FHA financing depends on your loan size, their downpayment, and your location.

The biggest price of an enthusiastic FHA mortgage is frequently not their home loan rates. In reality, FHA fund normally have lower interest levels than just similar antique financial prices through Federal national mortgage association and Freddie Mac computer.

FHA financial insurance premiums (MIP) try repayments built to the fresh new FHA so you can ensure the loan facing default. MIP is when the newest FHA accumulates dues to keep the system accessible to U.S property owners for free to help you taxpayers.

In contrast, anybody can apply for a keen FHA mortgage

- The first region is named initial MIP. You could pay that it aside-of-wallet within your closing costs, keeps an empowered family vendor spend it for you, otherwise wrap they to your the financing balance. It’s up to you

- Next region arrives due on a yearly basis. It’s your yearly MIP. Your own home loan company will separated this yearly commission for the twelve installment payments and incorporate you to each of your month-to-month mortgage payments

Yearly MIP can vary as high as 0.75% for highest-pricing belongings from inside the areas including Orange State, California; Potomac, Maryland; and you may New york city.

For most consumers, MIP is actually anywhere between 0.40% and 0.85%, according to the loan term (15- or 30-year) additionally the mortgage-to-worth (placing lower than 10% down, their MIP was higher).

Just remember that , in lieu of antique mortgages, FHA MIP cannot end after you have paid off your loan as a result of 80% otherwise 78%. They remains in effect as long as you have your home loan. For folks who put ten% or even more off, FHA MIP expires immediately after 11 decades.