The cash you borrow with a mortgage generally is inspired by people and you will organizations whom deposited they along with your lender. It is far from your lender’s money, it is someone else’s. Their financial will pay all of them focus to your use of the money.

A loan provider, instance a financial, should pay earnings Greenville loans, investors or any other expenditures. Nonetheless they need to make a return, just like any almost every other business. To do this, their financial charge you attention into the currency you acquire as a result of their mortgage. However they merely keep a small section of it. All attract you pay discusses the interest the lending company is useful the individuals whoever money you owe. So that the bank can make sufficient to stay static in team, home loan interest levels are always more than discounts and you can capital interest prices any time.

Most of the currency a loan provider features accessible to provide comes out of anybody, companies and you will organisations that have money to put toward an account. But banks plus obtain off general loan providers to another country therefore the Put aside Bank of the latest Zealand.

The lending company must keep the interest levels it’s to help you dealers glamorous sufficient to make sure dealers deposit sufficient currency together. Yet not, rates of interest are primarily dependent on just what to another country loan providers you will be capable of getting in other places, also just what Set aside Lender try asking.

This new Set-aside Bank’s lending speed simply above the certified dollars speed, otherwise OCR. It place new OCR seven times a-year to determine the brand new pricing one to lenders charges borrowers and pay depositors. This will help so you can determine things such as individual purchasing and rising cost of living. Therefore since the Set-aside Lender could affect interest rates to a few the quantity, their only the main tale. Pick a hold Bank videos regarding how this new OCR functions.

Just how do loan providers estimate your normal financial attract payments?

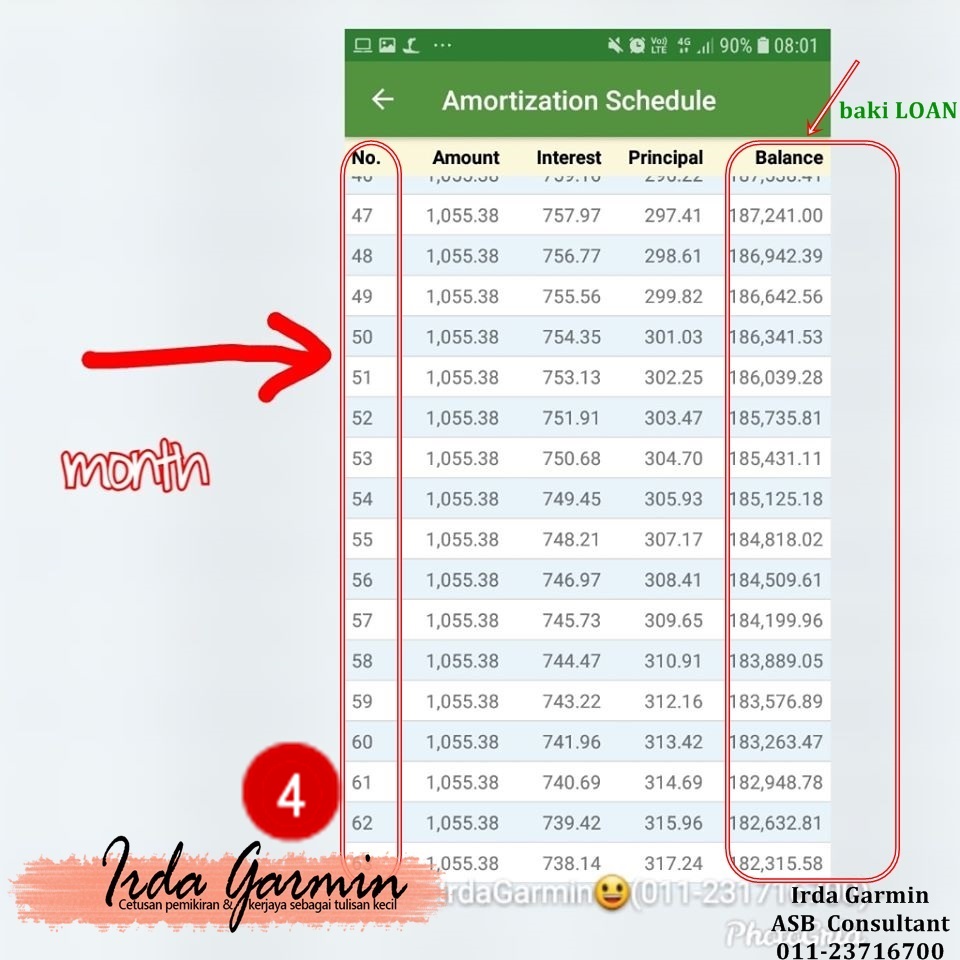

Quite often, your bank exercises the eye charge each and every day, based on how far you still are obligated to pay each and every day. If it is returning to your each week, fortnightly otherwise month-to-month mortgage payment, they simply add up all the each day desire fees because your past commission which will be the attention you only pay.

Instance, imagine if you are on a predetermined rates attention just financing (i.elizabeth. zero principal costs are subtracted as well as your equilibrium will stay a comparable after your loan period) and your fixed home loan interest was six% p.a beneficial. (per year) in addition to count you continue to owe now is actually $five-hundred,000. Might assess six% of $five-hundred,000 = five hundred,000 x 0.06 = $30,000.

But you to interest rate is actually for annually, so they really separate the solution because of the number of months from inside the the entire year, that’s 365 (otherwise 366 for the a jump season). That implies the fresh day-after-day appeal energized to possess today is $29,000 split by 365 weeks = $.Every day desire charge = (count owing x rate of interest) / weeks in the year

Playing with our very own home loan repayments calculator

As you can tell, workouts a daily notice fees to own today is relatively upright send. But since you repay several of what you owe with each normal fees, your day-to-day desire fees will slowly fall off. Just how are you willing to exercise the entire desire you’ll be able to pay across the longevity of your loan?

All of our on line home loan repayments calculator tends to make that really effortless. You only enter some loan information plus it instantly reveals your normal payments while the total appeal you can easily spend more living of loan. Its an extremely useful product because you can is actually other scenarios and you may immediately see the influence on your normal money in addition to overall interest you’d shell out.

- An amount borrowed

- A fixed or floating rate of interest

- Regular most recent costs offered or that you decide on

- Just how long we should shot pay back the borrowed funds (term)

- When your normal costs often pay-off some of your balance otherwise just the focus due

- A week, fortnightly otherwise month-to-month repayments

- While making a one-away from lump sum payment cost in per year of your choosing

- Boosting your typical fees from the one matter