In the three weeks day, the loan servicer went away from informing the fresh new bankruptcy proceeding courtroom, below penalty from perjury, that loan is actually most recent, to help you telling brand new homeowner you to she was $50,000 trailing. The complete tale appears here.

There, in short, the thing is that new total disarray for the real estate loan accounting whenever an effective bankruptcy proceeding is on it. (Indeed We doubt the latest accounting is any better away from personal bankruptcy, but that is another type of tale.)

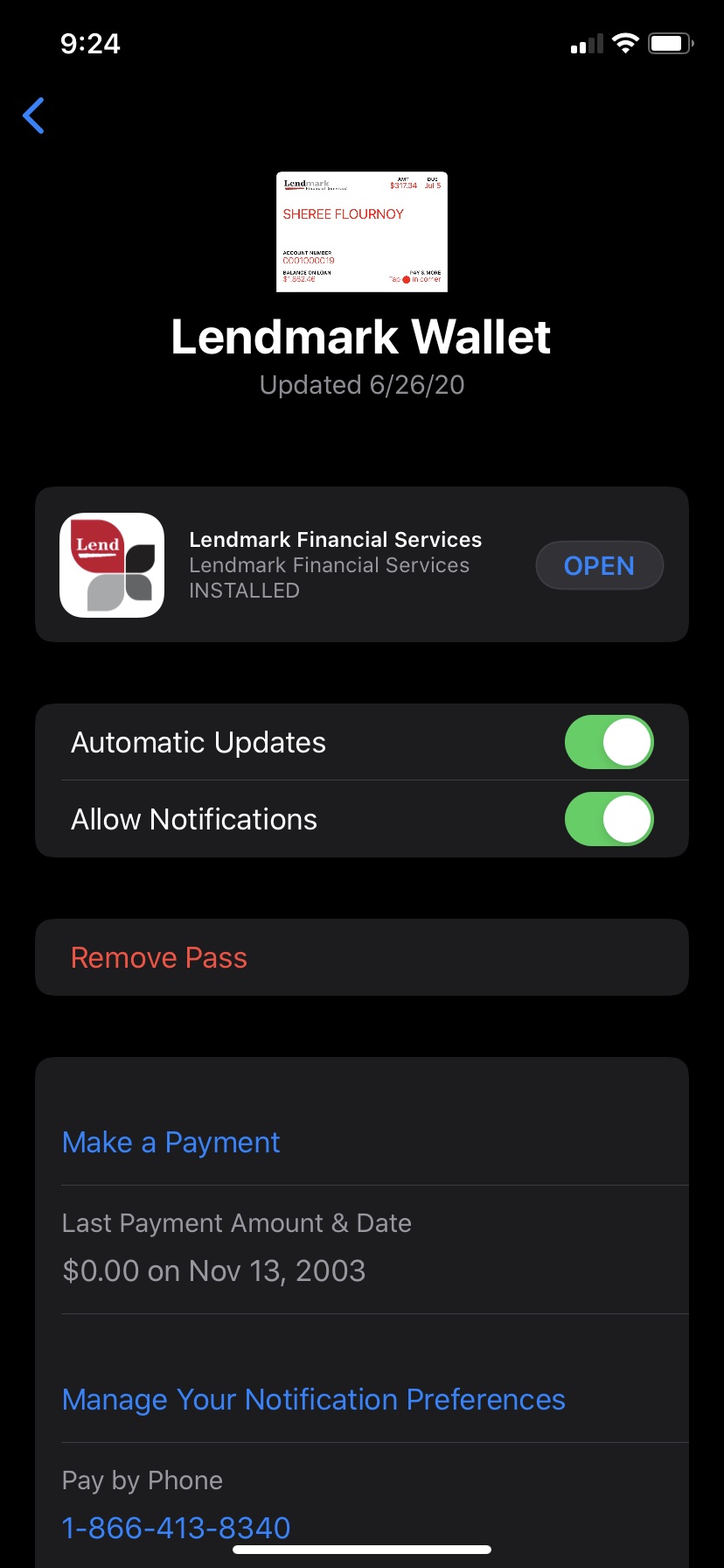

Mortgage once Chapter 13

You get current using many years inside Section 13, result in the money after you file, and then is actually slammed with a statement claiming you are at the rear of. Or tough, you get a property foreclosure observe.

The issue is actually widespread adequate your national bankruptcy proceeding laws committee blogged a tip trying lead off of the situation. That’s the way we got FRBP 3002.step 1.

The laws requires lenders having a beneficial lien on your home to give find while you are for the Chapter 13 regarding changes to the payments as well as charges and you may expenditures put into your loan. Up coming, after the scenario, they need to document an answer showing whether or not they agree totally that you are current blog post filing on mortgage.

Yet over repeatedly, financial servicers, people who are supposed to track your repayments on the mortgage, give the fresh bankruptcy judge that you are newest for the a processing signed significantly less than penalty out of perjury. Then they turn around within months, and you will play another type of song. In one of my personal instances, days after advising the case of bankruptcy court she is most recent, Larger Bad Lender told you she is $fifty,000 about.

And it’s really happened many times only this year. Brand new servicers either have no idea, otherwise dont care, whatever they tell this new courtroom regarding the loan.

While it is supremely galling, you’re not in place of ability to sort the difficulty aside. No matter if the personal bankruptcy case is more than, you have unforeseen loved ones: personal bankruptcy rules by itself; new bankruptcy judge; and your lawyer.

Making your own real estate loan correct

People which penned the fresh signal need got a good premonition that the signal requiring revelation and you will transparency wouldn’t alway functions. Here is what it wrote regarding the specialized statements towards the Laws.

If the, pursuing the chapter thirteen debtor enjoys complete repayments beneath the bundle together with instance has been signed, new owner from a declare secure by the debtor’s principal quarters seeks to recoup quantity that should was in fact however, weren’t announced below which rule, new borrower get proceed to feel the case reopened in order to find sanctions against the owner of allege significantly less than subdivision (i).

This new Bankruptcy proceeding Code contemplates that you may have to reopen a finalized bankruptcy proceeding case to seek save. There’s a technique for reopening the truth.

You might have to progress the fresh submitting commission, however you can either obtain it reimbursed of the the brand new courtroom, otherwise assemble they about servicer.

Home loan company face difficulties in the legal

If you ask me, the lender which filed an announcement toward judge saying the brand new loan was current following delivered home financing declaration claiming an arrears arising from that time of your case of bankruptcy provides a couple issues.

You to problem is you to definitely matter of official estoppel, the concept that a party can not simply take you to standing up until the case of bankruptcy legal and something in a condition laws property foreclosure step. In the event the there were outstanding number after this new bankruptcy proceeding case, the latest Laws 3002.step 1 process are supposed to clean the individuals out until the bankruptcy circumstances was finalized, and eliminate all of them.

The second issue is you to definitely tries to gather costs released otherwise paid-in https://www.paydayloancolorado.net/sheridan/ bankruptcy proceeding violates the production injunction. There are well oriented answers to contempt away from a national judge order.

It’s problematic if the bank keeps its lien for the property. It’s a main tenet away from case of bankruptcy legislation one liens transit case of bankruptcy unchanged, except if new courtroom requires particular tips to evolve the brand new lien.

Thus, residents need monthly comments just after its bankruptcy. The laws actually want it. But those individuals statements should be best and in line with exactly what the lender informed the judge lower than Signal 3002.1.

Rescue and you can recompense inside courtroom

Additionally, it may were your order deciding the financing equilibrium is really what the lending company very first said, or even the judge after computed. Its unsure whether or not the debtor can get well injuries to possess mental distress or other types of monetary injury.

- Which titled you?

- Exactly what performed they say?

- Was they trying to get one pay?

For individuals who come across mortgage problems once bankruptcy, contact your bankruptcy proceeding lawyer. If the lawyer just who addressed the case will not feel comfortable with these kind of instances, request an advice to a legal professional who does.