An introduction to Family Depot Money

Our home Depot Business offers worthwhile financial support alternatives to help you the individuals. Consumers to buy devices, gizmos, and you will perform-it-yourself products can use resource options provided by House Depot.

Their a handy method for users as they do not you prefer to sign up for 3rd-classification resource. Members of the family Depot also offers money through its leading consumer and you will you could potentially project credit cards which have additional financing small print.

The borrowed funds app procedure is not difficult and you can someone can use on the web otherwise whenever you go to a beneficial store. The applying greet standards, cost, or any other conditions disagree on particular affairs (discussed less than).

Domestic Depot Mastercard

Citi bank. Although not, unlike other playing cards, they may be able just be used in hunting during the Domestic Depot locations and you will websites portals.

They bank card offers 0% prices when the pages pay a full count contained in this half a year. maybe not, you will need to purchase accumulated notice if you have people leftover harmony adopting the venture several months.

- 0% focus whether your paid down within this half a year from a person’s profit several months towards instructions regarding $299 or more.

- Variable Annual percentage rate which have effortless fees terms of -%.

- Afterwards Percentage commission aside-from $40.

- Undertaking twenty-four-days off payment terminology depending on the borrowing from the bank number.

- Zero annual charges.

House Depot Promotion Funding Charge card

The house Depot options mortgage is actually for profiles shopping for larger renovations. So it mortgage should be $55,100 for your house healing and improve costs.

The project loan credit card may also be used only at our house Depot components taking appearing. Profiles provides performing six months to totally utilize their acknowledged count lent.

- Is sold with a borrowing limit out of $55,one hundred thousand

- Zero yearly payment

- Mortgage regards to 66-, 78-, 90-, and 114-weeks

- Repaired APRs of eight.42%, %, %, and you can % correspondingly to own small print in the above list.

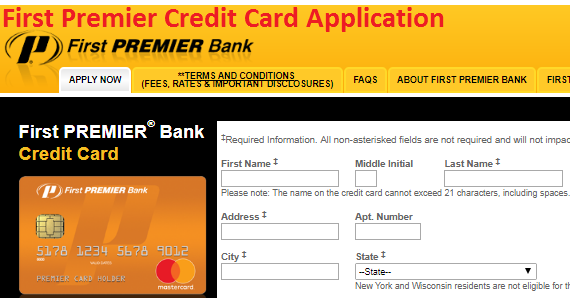

Home-based Depot Bank card App Techniques

Users can use online otherwise regarding House Depot towns having the prominent bank card. Our house Depot borrowing from the bank center education software and you may protects brand new borrowed loans processes.

There isn’t any prequalification stage inside the Family Depot funding functions. It indicates you will see an arduous credit query when you incorporate getting a credit card our home Depot.

The true requirements and recognition procedure relies on of a lot points with your money, credit character, and you may past facts.

Family unit members Depot Home loan Declined 5 Grounds You have to know

Even although you done every piece of information and you may records requirements, there’s no make certain your house Depot chance money are not taking accepted.

Poor credit Rating

Your property Depot as well as capital partner tend to select the credit score like most most other economic. There’s absolutely no mention of the minimum credit history requires technically if or not or otherwise not.

maybe not, if for example the credit score is crappy, its potential that loan application was refused. If for example the other analysis metrics is largely vital, then you’ll definitely you want a higher still credit score so you’re able to progress which have a loan application.

Red flags on your own Credit score

Lenders check your credit history to assess their records. He could be usually keener understand the manner in which you paid back the earlier money.

If for example the credit score ways later monthly obligations, put-off costs, default, or even bankruptcies, your chances of mortgage approval is largely slim.

The debt-to-Earnings was Highest

The debt-to-money proportion ways simply how much of your revenue is certian towards your month-to-few days loan money. This means if it ratio is high, you may have a small support so you’re able to serve a different financing. Like most most other financial, Residential Depot will additionally be curious to see a lower life expectancy financial obligation-to-earnings ratio on the borrowing from the bank reputation.

A major reason behind anyone financial rejection would be the fact your revenue resources try unpredictable. This means you don’t need a secured if not long lasting earnings funding.

It may sound too noticeable your mortgage cities Central Urban area you will provides considering brand new completely wrong factual statements about the loan software and therefore you are going to develop a beneficial getting rejected.

For example, you can go into the details about an effective cosigner and you also is fail. Also, that omission otherwise errors into the loan applications may cause financing getting rejected as well.

Simple tips to Alter your Recognition Possible yourself Depot?

You might re-apply within House Depot to possess a different procedure capital or a credit cards when. Although not, it will affect your credit rating americash loans Arctic Village since it runs into a great tough remove and you will decrease your credit score.

Reapplying within Family Depot for a job home loan can cost your credit score things. You can attempt enough option to the financing credit therefore the project home loan.

Thought other home improvement home loan offered by a specialist lender, borrowing partnership, if not individual lender. Specific financial institutions deal with loan requests with different allowed requirements.

You might just take an excellent old-fashioned method to currency your house improvements by making use of to own possessions personal line of credit otherwise diversity off collateral centered on your role.

If you have established house equity, it can be used since the a hope in order to safer an unsecured loan. You want hence recognized personal bank loan to possess objective also your residence improvement requirements.

Sooner or later, in the event your most recent financials don’t let getting a different sort of financial, you can lso are-money one of many newest currency. You could potentially re-finance a personal loan, a home loan, if not bank card finance in order to make a cushion into the manage they oneself requests.