Owner Builder Structure Loan

Manager builder financing are present for individuals who wish to deal with strengthening their house instead interesting an authorized creator. In order to follow it, one needs add this building plans to the regional council, and start to become granted appropriate strengthening it allows, which includes Da, and CC.

Once council recognition might have been supplied getting a proposed framework, men will be apply at its local government power getting an owner creator permit. The latest fund aspect for a proprietor creator loan would be advanced and hard, and then we strongly recommend your manage home financing Business build mortgage specialist within this version of count.

You really need to look for pre-acceptance in advance of entering into a manager builder arrangement. Associated with effortless, strengthening was a complex do so requiring a great control and you may technical experience.

Lenders know the complexity holder developers deal with, as well as the odds of will cost you more than runs. So it happens primarily away from inexperience which have dealing with these opportunity. Which extremely lenders aren’t good when it comes to lending within large LVR’s towards a holder builder loan.

Through getting an effective pre-acceptance, there are smart of exactly what your restrict financing amount might be and also at just what LVR terms.

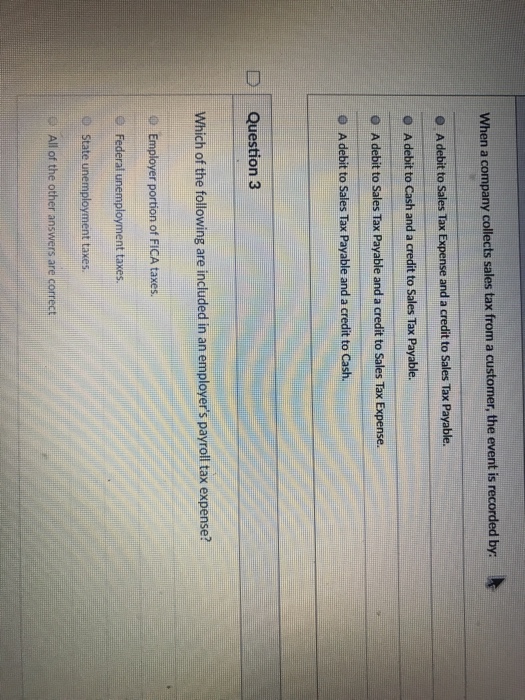

What is the restrict a loan provider usually lend towards the an owner builder mortgage?

The maximum LVR you can improve since a manager creator since complete doctor is 80%. This might be receive with only dos lenders in australia. In addition, other lenders will normally deal with fifty-70% LVR.

What really works should i demonstrate that I’m able to out of raising an owner builder financing?

Lenders require http://www.elitecashadvance.com/payday-loans-ms you to manage a owner builders pricing guess in advance of you begin framework. This will be a report away from what trades are needed as well as their costs. This needs to be assembled due to the fact a repayment guess, by yourself. In several respects, a lender will assist by providing you a repayment imagine theme that will try to be a robust guide, but it’s vital that you keep in mind that assembling your shed possess limited variations. When this is completed, a lender valuer or perhaps an amount surveyor will show new can cost you estimates given that enough and you will reasonable. The manager creator pricing imagine differs than simply a licensed creator financial in which a licensed builder provides a predetermined rates building plan.

Highest LVR lender’s should cause for a backup part in the the newest lending imagine. Thus that they like you to definitely an integral part of money end up being left aside of the complete strengthening speed to fund one unanticipated expenses. According to the bank, new contingency will be anything ranging from ten% of your from full structure will set you back, 20% away from overall design will set you back.

While i make, how does this new funding process really works?

Just after an installment estimate is eligible and you may affirmed because of the banking companies valuer otherwise QS, then the financial circumstances a beginning page. Since lender usually lend only to restriction off 80% of tough prices, then a consumer need certainly to lead 20% of your own finance by way of dollars.

Which, the building will very first end up being financed from the client while they often lead their cash earliest – to help you 20% of your can cost you. The financial institution at some point finish the endeavor giving the newest 80% away from financing necessary for the project as over.

Was owner creator money more costly?

Because there is a regulation toward number of loan providers who render manager builder funds during the highest LVR’s people assume they want to be more expensive. Typically, they are usually valued similar to other structure loans, yet you can find a handful of loan providers who price them costly. Considering obtaining these loan, excite search a casing mortgage expert out of Home loan Company.

During the Financial Team, we know finding the cheapest and most flexible design loan companies. We could get a hold of that it to you personally when you receive an independent builder, if not if you are acting as a holder builder. Our group features wrote magazines and posts during these subjects. Communicate with us for more information.