- A great 2022 investigation suggests that property owners invested an average out of $22,000 into home improvements.

- Money options are available for financial support a property endeavor, such as for instance security finance, credit cards, and refinancing your own financial.

- Once you understand your project timeline and you will security makes it possible to choose the best option for you.

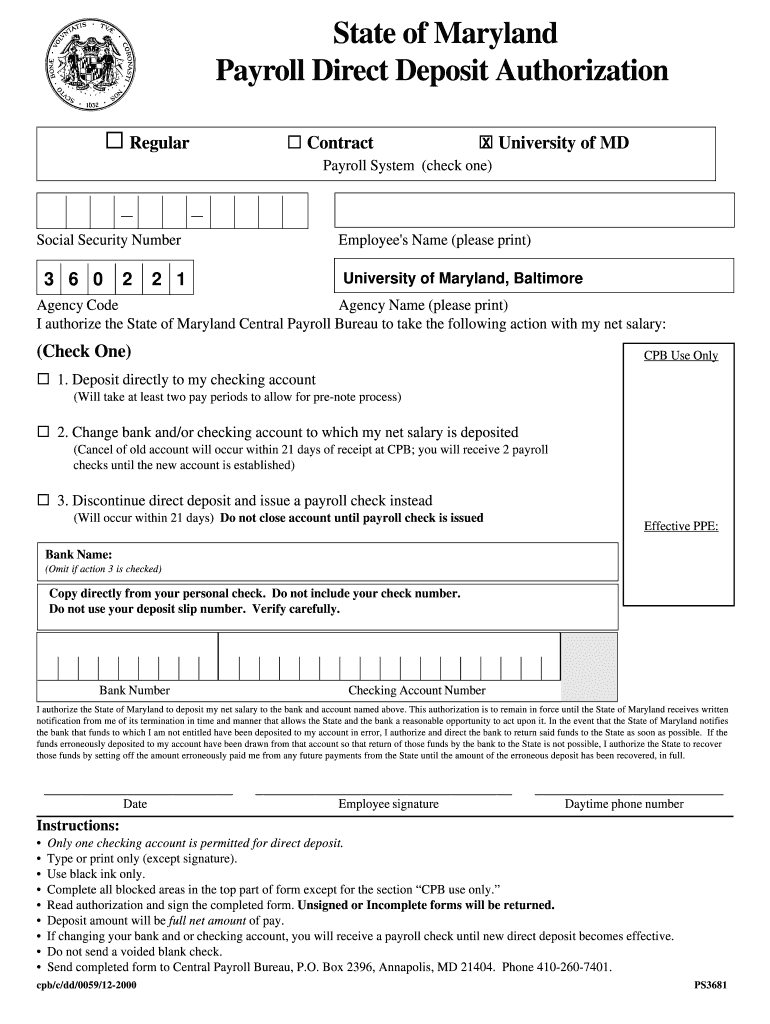

Home ownership is sold with unavoidable fixes or perhaps the wish to offer their space an update. A recent study revealed that inside 2022, people invested an average out of $twenty-two,000 towards home improvements, along with fifty% of these probably spend at the least $fifteen,000 for the upgrades.

But never allow price of these types of programs frighten you out. A good amount of capital choices are readily available that may create all the difference between bringing any home renovation otherwise fix alive, of a cooking area renovate so you can a roof replacement for otherwise water damage and mold repair. Navy Federal Credit Commitment, such as for example, now offers some options for the members with respect to the size regarding their residence endeavor.

“I always tell our very own professionals to take on its renovation requires and you may current economical situation,” told you Adam Fingerman, secretary vp off equity credit on Navy Federal. “Next, we’re going to assist them to narrow down the options to obtain the best financing product to fit their needs.”

There are many funds that suit different kinds of strategies. Fingerman means doing assembling your project by getting an offer of one’s extent out-of works, the fresh new timeline, and the will set you back. Those people activities can help you choose which mortgage helps to make the extremely experience to suit your restoration otherwise fix.

2. Family guarantee line of credit (HELOC) was an adaptable choice for highest methods

A property equity credit line, with a changeable speed, makes you utilize the collateral in your home once the equity to borrow cash on a towards-required foundation, doing your own credit limit. This is a good solution for those who have a much lingering do-it-yourself tactics.

step three. Family guarantee loans fund a one-go out investment

A home equity loan provides a single-time lump sum payment of capital from the borrowing up against the equity in your residence. It is good for a more impressive-size, one-go out project that needs a specific amount of financing eg a pool, efficiency improve, or remodeling an individual area. Because you pull out all fund initial, it is possible to plan assembling your shed that have a definite funds for the brain. Concurrently, this one is sold with a predetermined rate of interest for the entire time of the loan.

4. Refinance your residence to pay for a job

A finances-out refinance is a home loan choice enabling you to use more money by the refinancing your home loan and you may making use of your own accumulated house equity.

5. Home improvement money bring financial support for arranged solutions

Property update financing offers money initial without needing equity. Money are ready at the a predetermined speed, providing balances and you may predictability throughout the payment period. Additionally, during the Navy Government, you could generally discovered capital on the same date you apply, making it great for abilities improvements otherwise remodels such as for instance landscape or turf overhauls.

6. Individual debts fund financing urgent fixes

Individual expense financing are of help getting resource day-sensitive and painful family expenses while they normally have a quicker software techniques than many other financing. That is ideal for “a greater number of home-associated expenditures assuming you desire currency rapidly,” Fingerman told you.

eight. Consider using a charge card having quicker tactics

“Some people don’t want to leverage credit cards having funding home improvement programs, these could be a special capital selection for property owners,” Fingerman told you.

He advised using these having short strategies you could pay from rapidly. Likewise, by using a benefits credit card, you can earn perks and activities for your sales.

Such as for instance, brand new Navy Government Flagship Benefits Credit card will be a good choice for big date-to-big date otherwise reduced purchases, while the you can easily earn circumstances once you purchase. Navy Federal’s non-rewards Rare metal Bank card is an additional charge card selection for larger domestic plans otherwise disaster repairs because it enjoys its lower offered charge card Annual percentage rate.

Your house is going to loan places Norwich be a sensible investment

Consider what’s going on in the each other a nationwide and you will local height within the industry. Know very well what categories of home improvements is it is incorporating resale worthy of and therefore are appealing to potential buyers if you do to offer later on. In the course of time, it is important to perhaps not save money than simply you really can afford.

“Navy Federal also offers mortgage loans with 100% funding solutions, rates matches be sure, no individual home loan insurance policies (PMI) required, certainly one of other pros,” Fingerman told you. “Concurrently, i follow you to the life of your loan – ensuring the functions are available to your as soon as you need it.”