Every individual dreams of is a homeowner. It is a way of making certain lifelong safeguards that will not been away from located in a rented family. But to acquire a house is not an easy process. The home-to buy processes was careful. It requires each other years of patient saving for a deposit and you will new personality off a great place for forget the. While the assets financing takes the fresh new levels of money, the some one believe in submit an application for a mortgage. You’ll pull out home financing and repay it from inside the simple equated monthly installments (EMIs) having tenures lasting to thirty years.

The procedure to try to get home financing when you look at the Asia comes to several tips, which through to the digitization away from banking had been cutting-edge and you may big date-taking having candidates. Today, your house loan processes is not only simple in addition to short. The loan is often disbursed within this weekly when you implement having HomeFirst.

Complete the applying:

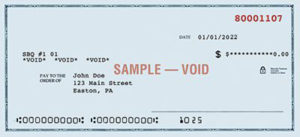

The method to make our home mortgage begins with processing a keen form. The application form is considered the most primary file in which you keeps so you can fill your personal facts about your own label, address, telephone number, profession, month-to-month and annual money, and degree facts, etcetera. That have an obvious thought of the house or property you would like, their projected pricing, as well as your affordable deposit will assist speed up the borrowed funds pre-approval techniques. This new borrower must furnish new id proof, address evidence, earnings proof, money permits, ITR of history 3 years, financial comments, etcetera, to one another on means.

Confirmation out-of data files:

After you fill out your documents, the lending company verifies the newest data provided with you. This might be a critical facet of the mortgage processes. Very, financial institutions may take around two days to ensure your write-ups. To maneuver submit together with your application for the loan, you will need to take effort and sit-in a face-to-deal with interviews within lender. This could be the latest bank’s way of confirming that you can handle settling your loan for the requisite tenure.

Background View:

Finance companies guarantee your posts and possess conducts an independent records have a look at of your own borrower’s history. Compared to that impact, the financial institution may carry out a study foundation the info given by your in the means including your past and you will latest residential address, your employer, credentials of your own company, work environment contact info, etcetera.

Getting your credit report:

This course of action might have been simplistic since that time RBI made it mandatory. The brand new mandate is done to possess credit bureaus to add their customers with a totally free credit history a-year. Consistent loan costs will be the answer to unlocking a beneficial credit score, creating within 750.

Their financial tend to charge a fee a non-refundable loan-running commission. Extremely finance companies fees ranging from 0.5 % and 1 percent of the amount borrowed once the control fees. Banks make use of this count having starting out and maintaining our home financing techniques. Lately, certain banks have taken to waiving loan-operating charge to draw individuals. You ought to discuss together with your lender and check out to take advantage of the main benefit. However, only a few finance companies are going to be intense into the handling costs.

Investigations away from Installment Capacity:

Confirmation of your own borrower’s cost capability is considered the most important part of the property mortgage techniques. What you can do to repay the loan (prominent and you may appeal) timely usually heavily influence the new bank’s choice so you’re able to sanction otherwise reject your house financing demand. Of course, if the lending company facts an excellent conditional sanction, the stipulated criteria will need to be came across before financing was disbursed.

Operating the house records:

When you receive the specialized sanction page granting your loan, you will be necessary to submit the first possessions documents into the financing financial, which remains within the bank’s child custody till the financing is paid back completely. The initial possessions data files generally include the whole strings regarding control purchase and you will transfers of possession inside succession till their Marketing Agreement execution, appropriate NOCs from relevant bodies with the seller’s identity, ID and target evidence, an such like. The bank verifies all related property documents ahead of giving the fresh financing. Bank and additionally sends its user double to physically check out the assets website, just after before acceptance of the mortgage upcoming after sanction of loan.