Savers are viewing higher efficiency today courtesy today’s higher-rates ecosystem, you might not be happy regarding the those individuals higher rates of interest while you are a debtor. At all, sensible borrowing options are scarce, that have rates on unsecured loans averaging to several%.

Fortunately, people who wish to acquire in the the lowest rate usually takes advantageous asset of their home collateral, experiencing just what they’ve currently repaid within their domestic by firmly taking out a home security financing or a house equity distinct borrowing (HELOC) . And you will, family guarantee factors typically have straight down pricing than unsecured loans, causing them to an ideal choice getting home owners. However, self-employed homeowners could have a harder time securing a HELOC. Indicating reputable income the most critical situations from inside the being qualified for a house security loan or HELOC, which isn’t really usually consistent having notice-operating professionals.

“It could be harder getting a personal-working borrower so you’re able to be eligible for that loan because the lenders perceive self-operating individuals are riskier than salaried otherwise each hour wage earners,” says Phil Galante, a mortgage broker which have ProMortgage in Ca. “Self-operating earnings is often not as regular or foreseeable as salaried personnel, who discover uniform paychecks at normal intervals.”

Taking out a home security loan if you are thinking-operating? Make use of these 4 specialist info

If you want to remove a home equity mortgage otherwise HELOC while the a self-functioning staff member, check out specialist-motivated resources which could help you qualify.

Continue intricate facts

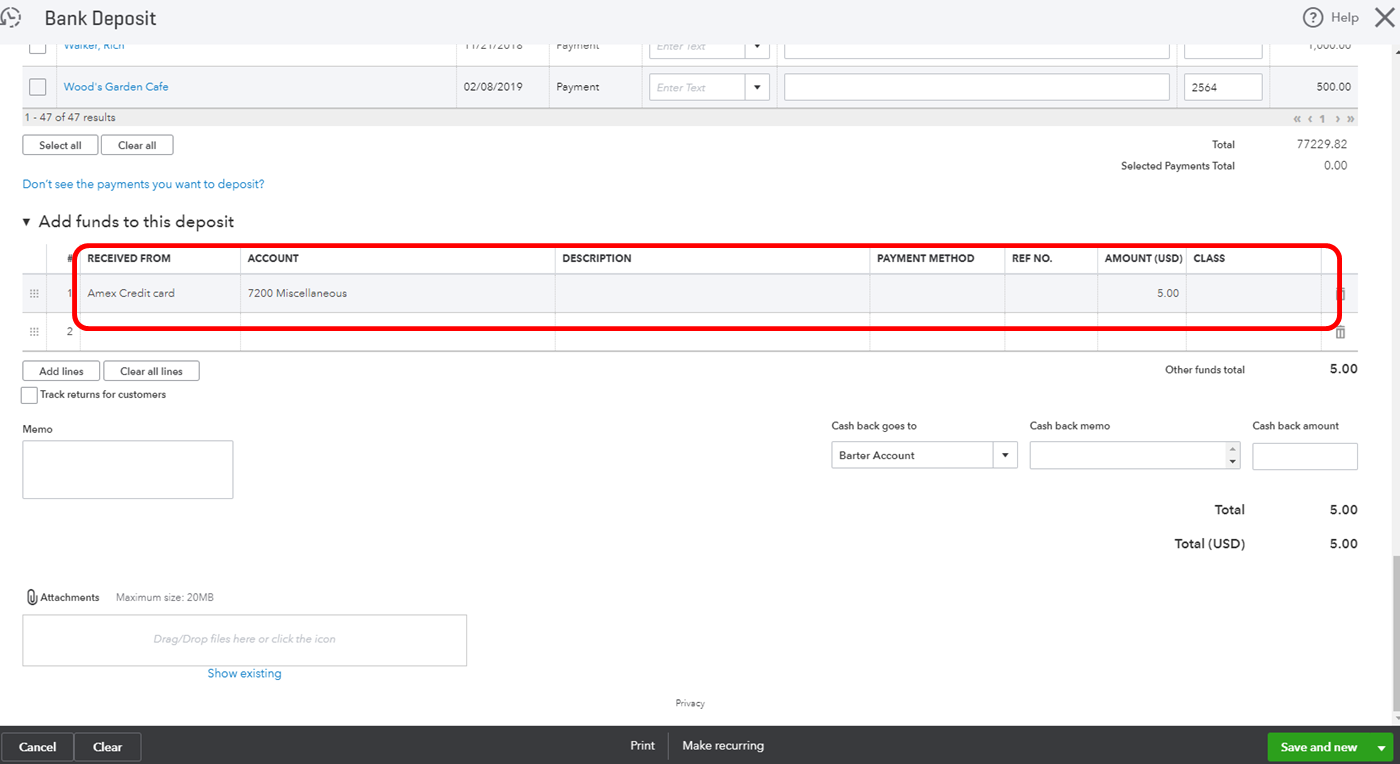

The better the number-staying, the new less it would be on exactly how to opinion your organization and private filings, advantages state – therefore the simpler it might be to possess possible loan providers to learn exactly what your economic image try. Meticulous, detailed info are very important regarding being qualified for a house equity loan otherwise HELOC.

“Never [commingle] private and you can providers expenses – they must be 100% separate,” Galante claims. “Keep precise or more-to-date facts of the business earnings and you may costs.”

In order that a and you will business financials is separate, this may assist to keeps a business bookkeeper deal with the company’s expenses and you may ideas and also a different sort of accountant handle your own personal costs.

Anyway, entrepreneurs normally excel that have loan providers by the indicating the funds, based on Joseph Hogan, CFP, large financial company and you will handling companion of WealthFD.

“Conventional financing applications tend to generally speaking assess your self-a position earnings using the average net income on the income tax come back for the past loans Joes two years,” Hogan says. “Work at the accountant to correctly capitalize and you can depreciate asset commands. Decline is a common create-right back getting loan providers, definition they will ban men and women costs whenever calculating your revenue.”

Improve your credit history

Borrowing of any sort tends to be the most affordable if you retain your credit score who is fit. And, it will typically must be high getting domestic guarantee issues than for to purchase a property, experts say.

“Whenever i did home based lending for a few biggest national banks, all had a high minimal credit rating getting eligible for a house collateral loan or line of credit compared to an excellent first home loan,” Galante says.

Therefore, before applying for domestic security circumstances , take some time to repay normally a great financial obligation just like the you can. Galante means paying down credit cards month-to-month and staying most other loans to a minimum.

Make sure that your taxation filings was right up-to-big date

Be certain that you’re as well as thought thinking-working considering your lender’s requirements – and therefore you happen to be keeping up with tax filings promptly. As an instance, do you have 25% or even more of the business? Is it possible you found an effective 1099 to own price work? Will be your income into the a timetable C setting with the Internal revenue service? You happen to be felt care about-operating for individuals who answered “yes” to virtually any of these.

“If possible, document taxation statements promptly unlike declaring extensions,” Galante says. “Underwriters usually want to feedback efficiency on the a few latest age. If there’s an extension for recent year, they are going to and additionally opinion the brand new Profit and loss statement for this year to confirm there isn’t a reduction in earnings in the earlier couple of years.”

Filing on time and you will to stop extensions signifies that your enterprise is functioning given that typical, which demonstrates to help you lenders you are responsible and well worth credit so you can, masters say. Requesting extensions, as well, might possibly be a red flag so you can loan providers.

Check around to discover the best lender

Not totally all lenders have the same standards and requirements. If you are worried about qualifying for a property equity financing otherwise HELOC which have one bank, you might qualify with another, it is therefore important to shop around.

And you can, often times, only being qualified getting a property collateral mortgage otherwise HELOC can be suitable, Hogan claims, even if you aren’t getting an educated rate. Self-employed borrowers you will deal with higher cost no matter what their complete economic visualize, so you could need to find other ways to lower the costs alternatively.

“Mortgages and you may house collateral mortgage rates are usually higher to have self-functioning consumers, specifically those which have smaller off costs,” Hogan says. “While making a larger downpayment on the mortgage and you will keeping an excellent at least six months from mortgage repayments into the bucks reserves can be considerably reduce the cost of the loan.”

The conclusion

Taking right out a property collateral loan whenever you are self-operating would be more challenging as opposed to have salaried or every hour professionals, but it’s maybe not impossible. There are ways to maximize your likelihood of acceptance, in addition to resources more than might help. Thus, in advance of finishing a loan application, guarantee that you’re qualified to receive a house security loan due to the fact good self-operating staff. Its also wise to run staying careful team and personal details, taking steps to boost your credit rating and you can research rates having some other loan providers to acquire that happy to work with you.