Mortgage brokers classification what files you prefer, nonetheless it revolves within the maxims. You’ll have to offer their ID, Societal Defense Number, proof house, and other advice to receive an excellent HELOC.

Step 4: Going for one minute Domestic

A rental possessions otherwise travel household provides you with more a property. It is possible to make money from rental income and really love. However, you must prefer a moment family that can generate confident earnings. Its fun to create a bona fide home profile, however, traders need consider the hazards when deciding on a moment house. It is preferable to examine multiple possibilities rather than settle to have a home that doesn’t line up along with your economic desires.

Step 5: Trying to get an effective HELOC

As you grow closer to to buy a moment house, you ought to make an application for a great HELOC. During this procedure, you may have went on and then make month-to-month mortgage repayments. Every one of people costs makes your home collateral and certainly will allow one utilize more funds if it is time for you create the fresh new down payment.

It’s a good idea available numerous lenders in the place of committing yourself to your current bank. Submission multiple software can lead to lower rates and help you will be making an even more informed choice.

Action six: Closing on your Mortgage

You are going to need to become approved to own a good HELOC immediately after which explore those funds to afford down-payment. For each and every closing will result in charges that will start from 2% so you’re able to six% of the loan’s balance. Playing with an effective HELOC to finance a downpayment can lead to more expenses, however, this method makes it possible to gather a residential property investment.

Before you use a HELOC for a down-payment, it’s good to think about the benefits and drawbacks. These represent the highlights.

Benefits associated with Using a beneficial HELOC for Down payment

- Aggressive interest rates: You’ll usually see you to APRs into the HELOCs is actually reduced than simply discover along with other loans points particularly credit cards, that are as well as revolving loans items that work including HELOC. Some lenders including extend introductory APRs into the HELOCs to possess a small number of days so you’re able to sweeten the deal and help result in the loan costs a whole lot more reasonable.

- Interest-only cost period: So you can piggyback from the last key work with, there are HELOC products that incorporate attract-just repayment periods. This means you are able to pay only notice to the number your obtain to have a certain windows, putting some financing payments even more affordable than just they’d become when the you’d to pay into prominent from the start because the really.

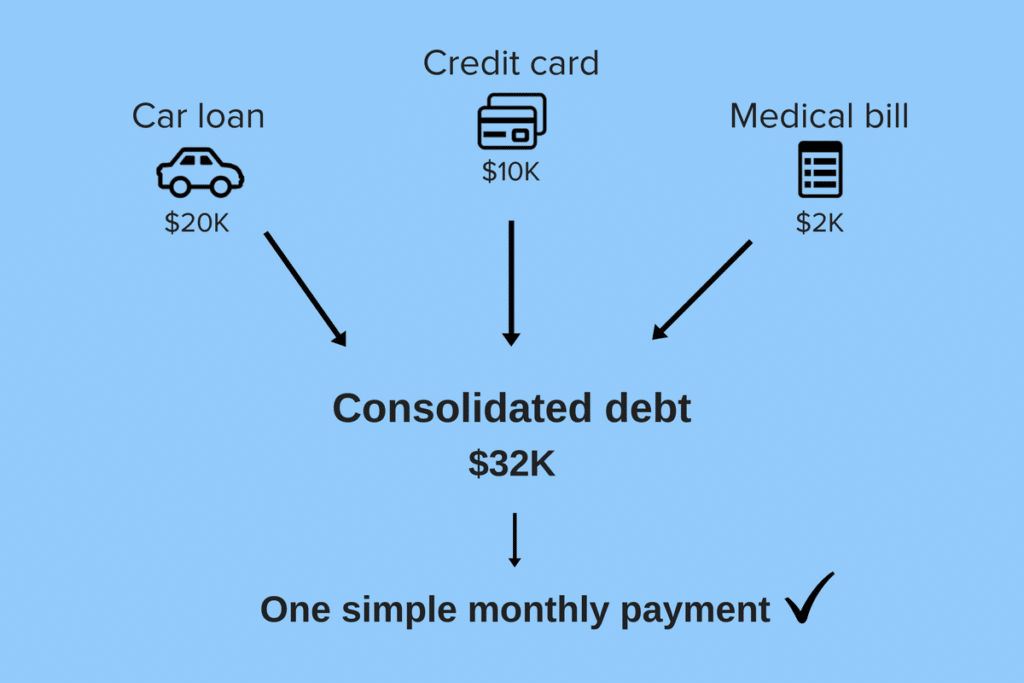

- No usage limitations: Regardless of if you want to so you’re able to secure good HELOC to use for a down-payment into a moment domestic, you aren’t simply for that debts. Truth be told there basically are not incorporate limitations with the HELOCs, payday loan Kersey to make use of the financing but you discover fit. You could find one attracting a portion to help make the down percentage and you will pay off highest-desire financial obligation sets you during the a better budget.

- Control borrowing costs: The financial institution sets the speed and other charges that accompanies the HELOC, you only have to build repayments into the number you acquire. You will not have this luxury by taking aside a house security mortgage and other fees mortgage device, no matter if, because you get the financing continues into the a lump sum payment and need certainly to pay when you look at the equal monthly installments more an appartment ages of date.

Downsides of using a good HELOC to have Down-payment

- Security requirements: HELOCs try safeguarded by your family. That said, surprise improvement in your position leading to help you pecuniary hardship you could end up property foreclosure if you can’t improve mortgage costs.