It is more than just a neighbor hood; it is a sanctuary having heroes into the consistent seeking to its cut regarding the Western fantasy. Household collect here, colleagues become lifelong family relations, and also the sense of area flourishes. Right here, your provider isn’t just recognized-its rewarded that have unmatched chances to plant roots and you can prosper into the property of the by using a great Va Mortgage.

Open San Diego’s Housing market which have Virtual assistant Benefits

No down payment with no PMI, a good Virtual assistant Financial stretches debt power within competitive market. Your path so you can property for the San Diego’s picturesque communities initiate that have Va-recognized warranty.

Lean in your qualification so you can safe a house amidst San Diego’s attract, without any economic weight usually experienced by many.

By forgoing the brand new advance payment, provider members spend some financing with other requirements, boosting the morale and you may creating sources during the a supportive people.

Influence the efficacy of no down to action to your San Diego house-savor economic versatility and you will a path to help you significant money on the coming.

The advantage of No PMI

Its lack of Individual Home loan Insurance coverage, or PMI, which have an excellent Virtual assistant Mortgage, scratching good monumental economic reprieve. Think of the versatility off homeownership from inside the San Diego’s important real estate We repayments-possible getting Virtual assistant Mortgage beneficiaries. Consequently, a lot more of your own difficult-acquired money stays in their pouch, boosting your to shop for fuel and you can enhancing your lifestyle.

By detatching PMI can cost you-a familiar importance of other sorts of loans-you can reroute people coupons towards renovations, furniture, if not your discounts to possess a rainy big date. Brand new Va Loan program exclusively allows army homeowners that have enough time-identity monetary masters outside the pick.

To the Virtual assistant Mortgage, have the economic tranquility that comes with lower monthly obligations. This type of deals enable you to arrange for coming lifetime incidents without the other question of PMI expenses-a real advantage to possess service players and you can veterans seeking to homeownership within the the new enduring center away from San diego.

Through providing PMI-free finance, the latest Virtual assistant permits veterans to thrive economically, indicating once more the brand new profound admiration our nation keeps for the solution people. Think about which advantage because you consider , observing new much time-term monetary progress doable without any extra burden out-of PMI, after that hardening brand new Va Mortgage as an excellent solutions during the brand new housing marketplace.

Self-reliance to have Economic Histories

- Flexible credit rating conditions

- Knowledge of novel military income provide

- Recognition out of non-antique credit history

- Consideration from earlier in the day economic pressures, along with bankruptcy otherwise property foreclosure which have compatible prepared episodes

Navigating San Diego’s A property with Virtual assistant Money

San Diego’s ranged neighborhoods consult an educated strategy. That have Virtual assistant Finance, provider participants can be with confidence discuss so it dynamic business, leveraging professionals tailored to their book position.

Navigating San Diego’s real estate indicates skills detailed industry trends, zoning regulations, and Virtual assistant mortgage masters that notably impression to acquire stamina. Expert advice assurances your benefit from these types of aspects to possess a smart resource.

Picking out the proper possessions melds army existence which have financial approach. Virtual assistant Lenders enjoy a crucial role, overcoming regular homeownership barriers during the San Diego’s competitive landscape.

Away from Metropolitan Condos in order to Seaside Homes

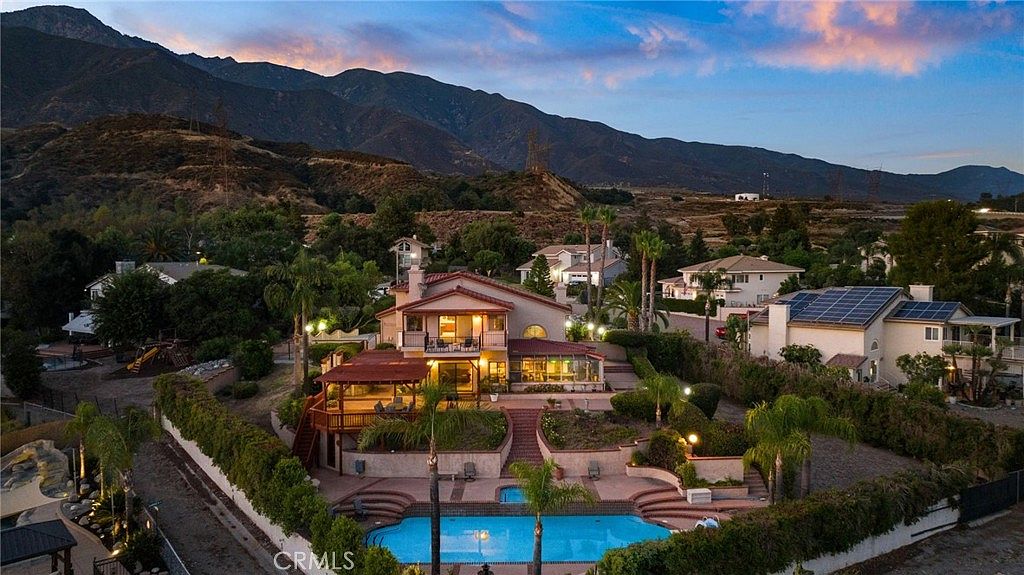

San Diego’s a property spectrum even offers countless choices for those that have Virtual assistant Mortgage brokers. Considering the assortment of urban condos set in the middle of the town, alternatives increase so you’re able to relax coastal property one to capitalize on ocean surroundings. Importantly, for each and every assets method of provides more lifestyles that is available that have Va resource.

Access to zero advance payment options is vital allowing you to consider services that features appeared regarding reach. Away from highest-increase apartments that have cityscape viewpoints in order to Clearview Oklahoma personal loans serene beachfront bungalows, Va Home loans supply the financial independency had a need to give including goals to help you fruition.