Most of us have heard of signs. Timely Dollars Now! Score Cash No Borrowing from the bank Called for! 12 mil Americans need cash advance and you can auto label funds on minimum one per year. Below are a few what you should consider before you can signup them.

People who sign up for car label fund and you can payday loans was usually looking for quick cash. They check out this type of “solution loans” for many grounds:

1. Zero credit score assessment required (credit rating graph)2. Quick and easy application process3. Brief loan (15-forty five weeks) 4. Quick cash

Audio high, proper? An incredible number of People in the us think-so. not, you can find essential information to be familiar with whether it concerns these types of solution funds.

step one. Cost

:quality(85)/cloudfront-us-east-1.images.arcpublishing.com/gray/ISZTBJSIAVGWDAYTGCNIEVVMRA.png)

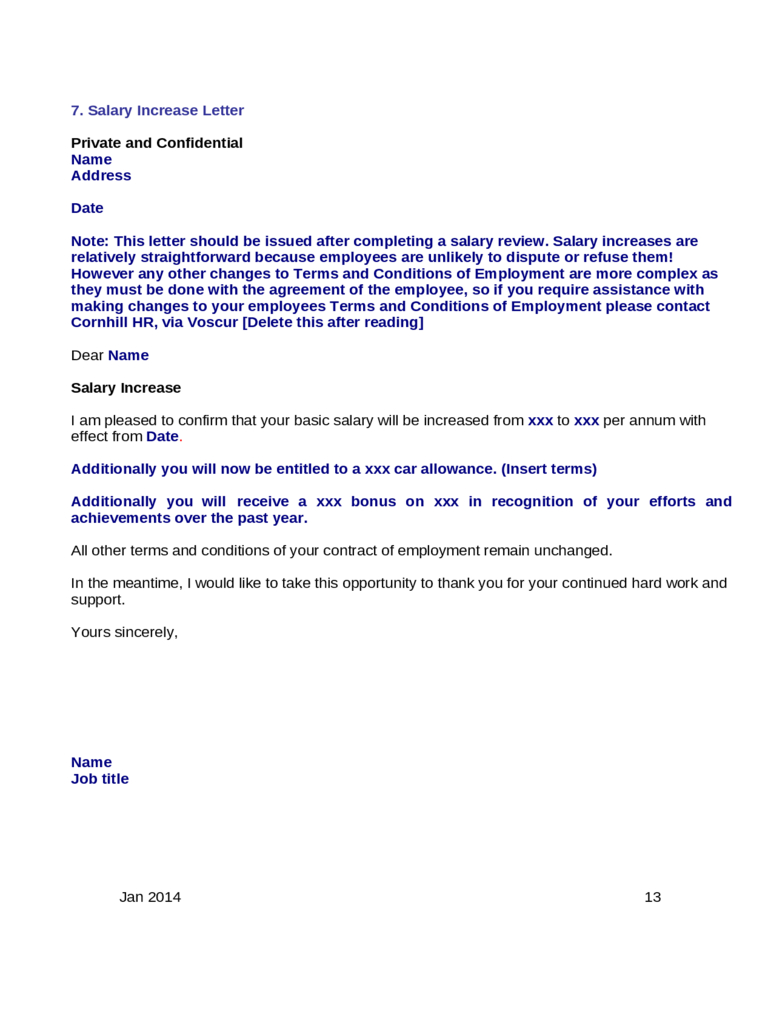

Annual percentage rate or Annual percentage rate ‘s the charge you shell out for each 12 months so you’re able to borrow cash, also costs, conveyed just like the a percentage. Whether or not it music perplexing, to not worry.

All you need to see is the fact that higher the newest Annual percentage rate, the bigger the loan. Here’s a graphic exhibiting fairly clearly new blazing difference in traditional mortgage rate averages and choice loan speed averages. Car label mortgage cost and payday loan prices are notably and you will scarily higher.

dos. Impossible Personal debt Course

For people who really only ever made use of an option loan immediately following good year, and had to spend the brand new ridiculous fee, maybe it wouldn’t be the conclusion the world. Nevertheless the the reality is, whenever you are pay check and you may auto label fund try reported while the helpful for an urgent situation, seven regarding 10 consumers are employing all of them to have typical, recurring expenditures including lease and tools, centered on .

That have expenditures you to soon add up to a much bigger number compared to household’s money shows that there’s a continuing cashflow material and you may that it’s almost certainly an equivalent disease may come over-and-over. Not able to generate mastercard lowest costs? These types of financing isn’t the address. Think of it that way – when someone is actually reasonable for the bucks and will get a payday/title financing, exactly what are the odds they will be lower into the dollars again 2nd few days, otherwise next shell out period? How will they be meant to shelter their living expenses And you may shell out straight back the borrowed funds with its charges?

The newest CFPB unearthed that more than 80% from payday loans was rolling over, or transitioned towards yet another financing unlike paid, within this two weeks. An equivalent CFPB declaration revealed that payday borrowers replenish their money too many times they wind up investing so much more in charge than just the total amount it to begin with lent. The typical cash advance debtor spends $520 from inside the charge for just what to begin with try good $375 financing. No surprise $eight million are reduced yearly to help you pay-day lenders!

Also, 1 in 5 people who look at the car identity loan processes end defaulting and you may shedding their automobile, predicated on Cymone Bolding, chairwoman of the Arizonans getting Fair Lending Coalition. If the vehicle is really worth $ten,000 and you also pay new identity to get a beneficial $5,000 title loan amount, do you know the chance which you can get that $5000 available ready to pay inside the a great month’s date? It is inclined you end incapable of pay otherwise just be sure to sign up for even more money to pay the initial one to.

One to More sensible choice: Generate a romance with a cards Relationship (or bank)

In the event we are keen on borrowing unions because they eliminate all of the affiliate as the the same lover of place, continue charges and you can costs reduced, and you may love its teams, also a financial surpasses depending on solution loan providers.

So what does they imply getting a great ‘relationship’ having a monetary place? It just mode you will want to open a merchant account and maintain they for the an excellent reputation for a little while. Here’s a few advice:

- Keep a positive balance during the a family savings and/or savings account.

- Incorporate $5 otherwise $10 to a checking account each month to exhibit you can consistently ‘pay oneself.’

- Beginning to generate borrowing from the bank by firmly taking out a tiny protected loan as much as possible.

- Or, is actually getting a great cosigner on financing or becoming an authorized associate on a dependable adored one’s account.

You could potentially make your credit along with your financial profile during the as the nothing because six-1 year. And because borrowing unions merely exists to help you suffice users, we are desperate to help you to get here. You can begin right here – of the reading debt health rating and ways to increase they.

After you’ve good credit (significantly more than 640ish), you may be in a position to be eligible for a personal type of borrowing to use when you look at the emergencies. Signature loans, Automobile financing and you will Mortgages are not impossible possibly. You will find numerous financing designs you’ll explore.

Even although you have a less than perfect credit background, we continue to have a bank checking account choice for you – our Is Once again Checking. You are going to need to grab an application to examine the habits off in control banking, and you will need to pay an upkeep payment, but you will be able to upgrade your Was Once more Checking account to a regular family savings for individuals who stay in high risk personal loans bad credit a beneficial position for one year.

End

Alternative financing organizations are likely to be on the market, in one single setting or another, however, that does not mean you to twelve mil Americans each year need to-be making use of all of them. Whenever we begin to pass on the definition of for you to begin a romance that have a lender otherwise credit partnership, while making it obvious precisely what the choices should be cash advance and you may vehicle identity funds, perhaps one count might be less.

step 1 This post is supposed to be an over-all investment just and is maybe not meant to be neither can it create courtroom information. People guidance derive from view merely. Costs, terms, and you will criteria is actually subject to alter that will vary predicated on creditworthiness, qualifications, and you may collateral standards. All of the loans at the mercy of recognition. Subscription is required.